The data and analytics firm disagrees with the US Department of Justice’s stance that the acquisition would result in higher prices, reduced quality and less competition

Contradicting the lawsuit issued by the US Department of Justice this week, broker Aon’s takeover of Willis Towers Watson (WTW) would instead “allow for a combination of complementary solutions, capabilities and skill sets that would better assist consumers”, said data and analytics company GlobalData.

On 16 June, US Department of Justice filed a civil antitrust lawsuit against broker Aon’s planned £30bn acquisition of WTW, alleging that “the merger threatens to eliminate competition, raise prices and reduce innovation for American businesses, employers and unions that rely on these important services”.

The complaint, which was filed in the US District Court for the District of Columbia, argued that the takeover would eliminate “important competition in five markets” by combining two of the ‘Big Three’ global insurance broking business.

However, Jazmin Chong, insurance analyst at GlobalData, argued that “Aon and WTW’s merger would allow for a combination of complementary solutions, capabilities and skill sets that would better assist consumers during a time where the pandemic has drastically changed the way companies need to make innovative and rapid solutions that mitigate their operational risks”.

She explained: “The combination of both Aon’s and WTW’s corporate capabilities would bridge operational gaps between both brokage groups, delivering better outcomes for clients.

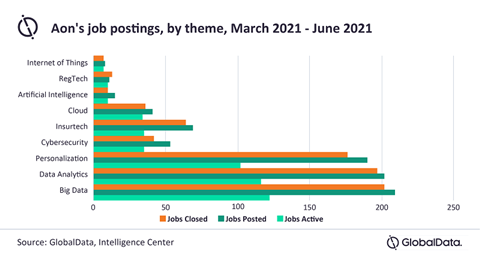

“GlobalData’s job analytics database finds that Aon has predominantly focused on data and analytics capabilities, with the broker increasing its hiring for cloud capabilities, personalisation and Big Data, all of which have experienced a 17%, 16% and 6% increase over the past 90 days, respectively.

“Over the years, Aon has built a scalable infrastructure that relies on cloud technology and artificial intelligence (AI). This has allowed the broker to develop a competitive advantage when it comes to offering clients insurance policy and risk management solutions, accounting for 42.3% of the company’s total revenue in FY 2020.

“Additionally, Aon’s revenue growth was due to strong performances in its US, Canada and Latin American markets.

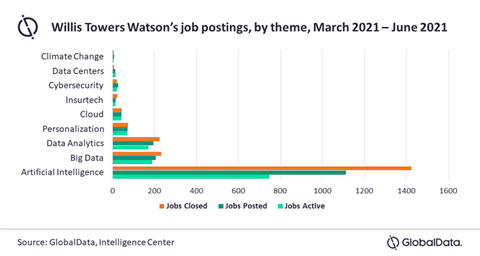

“On the other hand, WTW has developed a very different corporate strategy, one that relies on partnerships that outsources its technological capabilities. For example, in March 2021, WTW collaborated with HTC Global Services and Pegasystems to enhance pricing capabilities and workflow management.

“According to GlobalData’s job analytics, WTW is decreasing its staff capabilities that focus on AI, Big Data and data analytics, with all three themes experiencing a 29%, 12% and 15% decrease in recruiting for these sector roles over the past 90 days.

“WTW has [instead] focused on corporate risk and broking through e-commerce, with this segment contributing to 32.1% of its revenue in FY 2020.

“Additionally, WTW’s regional revenue growth is driven by strong performances in North America and Western Europe.”

U.S. sues to stop Aon’s purchase of Willis Towers Watson

- 1

- 2

Currently reading

Currently readingAon-WTW merger allows for ‘combination of complementary solutions’ – GlobalData

- 3

- 4

- 5

- 6

- 7

- 8

No comments yet