The London Market is looking to nurture innovation to sustain its position as a global leader. NIIT Insurance Technologies asks what is innovation, and what innovation approaches might help?

Definition of “innovation” is notoriously elusive, even in organisations for which innovation is a core part of their mission. Innovate UK – the government’s Innovation Agency, sponsored by the Department for Business, Innovation and Skills – does not give a clear definition of “Innovation” on its website (and when the current author asked them for a definition of innovation they referred him to a document from 2014). Similarly, as of 22nd July 2016, the London Market TOM’s laudable Innovation Exchange initiative does not share its definition of “innovation” on its website. Additional terms such as “disruptive innovation” and “open innovation” muddy the waters still further. The London Market has been told regularly to “innovate or die”, but what is innovation?

The UK’s Department of Trade and Industry used to assert that Innovation is:

…the successful exploitation of new ideas, incorporating new technologies, design and best practice [to enable] businesses to compete effectively in the global environment.

The emphasis on the “new” is presented in a more nuanced form by a recent blog entry on Innovate UK, which says:

One distinction when thinking about innovation is differentiating between something which is “new” and that which is “new to me”. The former could be seen to encompass brand new technological innovations… By contrast, “new to me” innovation encompasses proven technology being applied in new and creative ways.

The commentator’s focus on technology, however, rather limits the scope of innovation. The Department for Business Innovation and Skills’ Innovation Report 2014 expands the definition:

Innovation is the application of knowledge to the production of goods and services. It means improved product and service quality and enhanced process effectiveness.

The Open University suggests that the trend in the literature is to consider innovation as something that encompasses products, services, processes and strategy, and that “subsumes both originality and utility”.

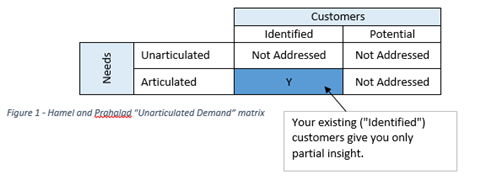

Traditional “Technology Push” – find a use case for a technology such as IoT – and “Market Pull” – ask your customers what they want through VoC and other feedback loops – approaches to innovation retain their validity but have their limitations. Hamel and Prahalad’s “Unarticulated Demand” model shows that asking identified customers what they would like misses three of the four available innovation opportunity quadrants.

Scanning the external environment, benchmarking and “creatively swiping” from the best, both from within the Insurance Industry and outside of it, is one way to gain insight into those unarticulated demands. Here at NIIT Technologies we have also embraced Design Thinking as a methodology to help break through the “mental tramlines” that develop inevitably over time as your deliver products and services in standardised ways. We are not just talking to and observing our “customer’s customer”, we are also talking to outstanding organisations in unrelated industries to understand their approach to their products, services, and people, and gain innovation insights for our world.

The characters traits of individuals that are to lead change in the London Insurance Market, and the culture of organisations within it, are also of critical importance. Cooper and Hingley’s study of UK “change-makers” drawn from industry, arts, business and the unions notes that a key trait of change agents is a restless dissatisfaction with the status quo, and cites the following common characteristics:

1) leadership qualities

2) ability to see connections between disparate things and stimuli

3) intelligible language for complex ideas

4) passion and persistence

5) recognition that change can be tedious and painful.

It can only be helpful if some of these “change agents” are drawn from outside of the Insurance industry, in order to enrich the insights of the market’s existing participants as they look to the future. These outsiders are also forces to counter the problem of “mortality of good ideas”; ideas that may be visionary for the market, but which are rejected as they do not fit the orthodoxy.

Global Reinsurance will be holding a Breakfast briefing entitled “innovation in the London Market” on 22 September in London. Click here to find out more and register.

No comments yet