Fitch Ratings-Paris/London-11 November 2020: Turkish insurers’ Insurer Financial Strength ratings are under pressure from the Negative Outlooks on the Turkish sovereign and Turkish banks’ ratings, Fitch Ratings says in a new report. However, in contrast to banks, insurers have limited exposure to lira volatility as policyholder liabilities are mostly denominated in local currency, and the sector’s technical profitability is strong despite the coronavirus pandemic.

Turkish insurers’ investments are mostly placed with domestic counterparties, primarily banks. The Negative Outlooks on the Turkish sovereign and Turkish banks’ ratings therefore feed directly into our assessment of insurers’ asset quality and operating environment, and insurers’ ratings are on Negative Outlook as a result. Fitch revised the Outlook on Turkey’s ‘BB-’ sovereign rating to Negative in August 2020. This was largely driven by lower foreign-exchange reserves, weak monetary policy credibility, negative real interest rates and a sizeable current account deficit.

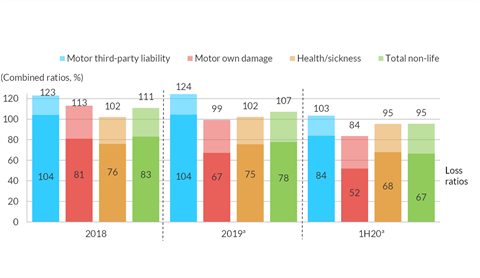

Despite the pandemic, Turkish insurers’ technical profitability was strong in 1H20. The overall non-life sector loss ratio (claims to premiums) decreased to 67% from 78% in 2019, and the combined ratio (claims and expenses to premiums) was below 100%, indicating a technical profit. This follows a series of technical losses from 2014.

Turkish Insurance - Combined Ratios and Loss Ratios

This strong technical profitability was driven by fewer motor and health insurance claims during the lockdown in the spring, when there was less traffic and a slowdown in healthcare (although claims may normalise in 2021). In addition, the sector has very low exposure to business interruption insurance, which has generated significant pandemic-related claims in other markets. Higher retained earnings and lower dividends to shareholders should help the sector’s capitalisation to remain adequate this year. We expect the market to become more sophisticated in the medium term, helping to address low insurance penetration (as measured by premiums to GDP).

No comments yet