Latest news

Fidelis Partnership promotes four to specialty line leadership roles

New heads for cargo, credit, energy and direct and fac in senior reshuffle at TFP

SCS can pose a challenge or an opportunity for ILS markets – Acrisure Re

Severe convective storm is emerging as one of the most significant catastrophe perils facing the US insurance market, rising from secondary to the bulk of nat cat claims in consecutive loss years, with rising losses driven less by changing weather patterns than by structural shifts in exposure

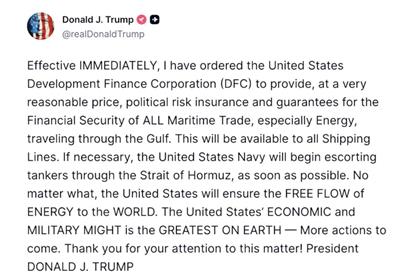

Iran conflict: Marine insurers weigh risk along with maritime industry as Strait of Hormuz traffic collapses

War risk cover remains available, but cancellations, spiking pricing and reinsurance withdrawals have contributed, alongside risk perception of insureds, to sharply reduce tanker transits through one of the world’s most important energy chokepoints

Attard named global head of reinsurance analytics at Aon

Strategy chief takes expanded role as the reinsurance broking firm integrates analytics across reinsurance platform

Iran conflict: Moody’s says credit impact on GCC insurers limited for now

Rating agency says investment portfolios, not claims, are the main transmission channel, though prolonged disruption could erode capital and weaken sector outlook

Iran conflict: Fairmont Palm and DXB attacks reveal coverage gaps for Dubai terrorism buyers

UAE businesses struck by Iranian missile and drone attacks, including Dubai International Airport and Fairmont The Palm, bought terrorism policies rather than broader war or political violence protection

QBE appoints Cryer as CUO of its international division

Stephanie Cryer’s promotion follows Nick Hankin’s move to lead QBE Re

Goldie to retire as CUO at MS Re as Bruniecki steps up

Jörg Bruniecki takes over as group CEO from Charles Goldie and Louis De Segonzac appointed chief technical underwriting officer in wider leadership reshuffle

Sze appointed CEO Hong Kong at Liberty

Unified licence structure takes effect from April as leadership transition begins

Miller to acquire Shields in Dubai to expand MENA reinsurance footprint

Middle East expansion for Miller adds DFSA-regulated broker and Lloyd’s admitted platform

APAC reshuffle at Gallagher Re; Perera and Jones take leadership roles

Leadership reshuffle at the reinsurance broker follows departure of O’Brien and retirement of Morley

HIVE expands into political violence and terrorism

PVT launch by the specialty managing general agent (MGA) builds on aviation, space and marine strategy

Skuld posts 6% P&I tonnage growth at 2026/27 renewal

Mutual book reaches 128m GT with further diversification across lines, according to the CEO of marine insurer Skuld

Price Forbes appoints Davies Bermuda head of property

Bermuda-based executive vice president to lead growth of property division for the broker

Lewkowicz appointed global lead for P&C capital modelling at WTW

George Lewkowicz to spearhead global capital modelling and reinsurance pricing solutions at the re/insurance broker

Guidewire survey finds London market brokers favour digitally advanced carriers

Tech capability increasingly decisive in placements as market softens, according to a survey of London market brokers

Synthetik warns UK SRCC risk now ‘route-based accumulation’ threat

New modelling suggests civil unrest insured losses could exceed £4bn under certain triggers, as carriers urged to rethink postcode-level accumulation approaches

BMS builds out A&H division with Early hire

Independent broker appoints five London-based specialists as it launches a dedicated accident and health team to support international growth

Aon names Fraccalvieri as CEO of global fac

Nick Fraccalvieri to lead global facultative strategy from March as Andrew Laing focuses on UK CEO role

From ‘drop in the ocean’ to scalable parametric protection – CelsiusPro’s Rueegg

Mark Rueegg, founder and CEO of CelsiusPro Group, explains why satellite-triggered re/insurance cover, premium subsidy and donor backing are critical to closing the climate protection gap in the Global South.

Divakaram joins Miller as head of treaty Asia

Singapore-based hire to drive regional treaty reinsurance growth for the broker