High inflation and claims expenditure on lines from motor insurance to property catastrophe events mean German reinsurance rates will rise, Hannover Re warned.

Hannover Re has announced, through its E+S Rück subsidiary for German risks, that it expects further price increases and improved conditions in the1 January 2024 renewals for property and casualty reinsurance.

Natural disasters and persistently high inflation have again taken a toll on the German insurance industry in the current year, the firm warned in a note timed for the start of the Baden Baden meeting in Germany.

A resulting ongoing rise in reconstruction and repair costs continues to adversely impact the insurance sector’s profitability, E+S Rück warned.

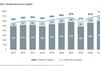

Hannover Re, which as a group underwrites more than €33bn of gross premium, making it the third-largest reinsurer in the world, summarised its home market renewals expectations like this:

- Significant increase in average claims results in substantially higher payments in motor insurance

- Frequency of medium-severity natural catastrophes leads to sustained high level of insurance payments

- Further modifications to risk-adjusted prices and conditions

- Heightened risk awareness drives sustained strong demand for cyber covers.

“We must assume that the multi-year trend towards higher claim payments will continue,” said Michael Pickel, CEO of E+S Rück, at this year’s reinsurance gathering in Baden-Baden.

“Adequate prices are indispensable if we are to be able to offer our clients the best possible reinsurance capacity in the future, as we have in the past.

“Particularly at a time of many different interrelated challenges, it is therefore vital for us as a reinsurer to tackle these issues and design solutions jointly with our partners,” he said.

“Moving forward, then, we shall continue to stand by our clients as their partner in managing losses caused by climate change and natural catastrophe risks – just as E+S Rück has done for 100 years,” Pickel added.

The insurance industry around the world increasingly finds itself faced with the effects of extreme weather phenomena, Hannover Re warned.

In Germany, too, the issue of coverage for impacts from heavy rain, flood, windstorm or hail as well as the associated costs remains front of mind for private households and commercial clients alike.

E+S Rück said that it expects motor insurance in Germany, the largest line of property and casualty insurance by volume in the country, “to close heavily in the red this year”., Persistently high inflation is also pushing up claims expenditures in property insurance, leading to pressure for further adjustments, the reinsurer stressed.

Average claims in motor insurance “again surged significantly in the current year”, while tariff adjustments “have failed to achieve the desired effects”, the firm said.

“Sharply above-average increases in the costs of spare parts and repairs as well as higher claims frequencies are causing massive losses and remain a heavy drag on motor insurers’ profitability,” said Pickel.

“Against this backdrop, we take the view that adjustments to prices in motor insurance are unavoidable in the coming years to move out of the red and restore business to a profitable footing over the long term. We expect to see gradual progress in this respect.”

Natural catastrophe losses were “below average” in the first six months, but summer storms “Lambert” and “Kay” caused considerable claims expenditure in August in southern Germany, Hannover Re warned. With this in mind, the company said 2023 is again expected to see substantial losses overall from catastrophe covers.

Sustained high rates of inflation plus the trend towards adding natural perils covers to existing contracts will drive claims expenditures for the industry even higher, the firm suggested.

In parallel, capacities on the reinsurance market remain tight overall, while demand for natural perils coverage is on the rise. All of which means prices for catastrophe covers “look set to increase further”, the company said.

High inflation has kept up the pressure for adjustments in industrial and commercial business, even though business interruptions due to supply chain bottlenecks have “normalised somewhat”.

At the same time, claims numbers and expenditures in connection with large fire losses have increased, the firm said. These developments should be reflected accordingly in modified scopes of coverage and conditions.

For liability business, discussions among market players will likely be similarly dominated in the year ahead by the issue of inflation as well as by the insurability of risks associated with so-called forever chemicals or PFAS.

For cyber covers, after “sharp price increases seen in past years”, the capacities offered by existing and new market players “should result in price stabilisation on a higher level”, the company said.

Pressure to make adjustments remains, however, due to rising claims expenditures, the reinsurer suggested. As a result, controlling and limiting cyber accumulation scenarios have taken on added relevance, as is also evident in contract terms and conditions.

“Despite the challenging market environment, I am confident about the upcoming renewal round, because our customer relationships and thus also the upcoming negotiations are always characterized by a cooperative partnership with all market participants,” Pickel added.

No comments yet