Hurricane Ian will exacerbate Europe’s reinsurance supply and demand imbalance, further driving up rates

The combined impact of economic and geopolitical crises is causing virtually unprecedented levels of complexity in the business environment for primary insurers and reinsurers worldwide.

This is according to Munich Re’s incoming chairman Thomas Blunck. Speaking in a virtual press conference ahead of next week’s meeting in Baden Baden, he said the outlook was ‘bleak’ and that uncertainty is a ’prevailing element that does increase more downside risk’.

Economic uncertainty is especially high. Munich Re’s Economic Research unit is working on the assumption that the eurozone will slide into a recession this winter.

Many markets are now seeing inflation rates reach their highest levels in 40 or even 50 years. In Europe, prices are being driven up primarily by energy and food costs.

Scenarios with even higher inflation rates are more likely to be seen in 2023 than those with unexpectedly lower rates. The outlook for commodity and energy markets, especially the gas market, continues to be a key driver of this uncertainty, noted Blunck.

”The energy crisis - especially in Germany - is growing more acute, and our assumption is that inflation will remain high next year. Recession is definitely imminent.”

“It is a gloomy outlook. In an asymmetric world, the probability for downside seems to be higher.”

Need for capital relief structures

These factors are leading to a steady increase in demand for reinsurance and retrocession. At the same time, however, reinsurers are seeing their capital bases and, by extension, their capacity decline.

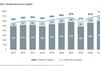

Blunck noted AM Best’s expectation that reinsurance capital would shrink by 8% during 2022. “The rise of interest rate levels is impacting the solvency of our industry - bond values in our assets are going down,” he said. ”This might have an impact on solvency available in the balance sheet.”

“This was already the case before Hurricane Ian but now that it has hit Florida, one has to take into account the trapped capital that needs to be available to pay the claims of the losses. This may mean that in Europe we have less capital available for the exposures here as an industry.”

“Our main message is that in this set of circumstances we stand by our clients, we have the needed capacty and can increase it according to inflation, but terms and conditions have to reflect these underying trends,” added Blunck.

”We have to be conservative as the downside risk seems to have a higher probability.”

As a result, cedants will need to retain more risk on their own balance sheets and, as a result, there is likely to be growing demand for reinsurance in the form of capital relief.

”Retentions will go up in the interest of our clients,” said Claudia Hasse, chief executive at Munich Re for Germany, Cyber Europe & Latin America. “They seek to get to a price level that is digestible and for this renewal it might be advisable to increase retentions.”

“Structured solutions distribute results over a certain period of time, and you do not have the same volatility in any given year,” she continued. “Financial instruments to smooth the volatility can make sense, depending on the price.”

Climate extremes growing

Blunck said the impact of climate change on Europe’s weather extremes was becoming more and more apparent. He said Munich Re was investing in high resolution modelling in order to better understand the impact at local levels of events such as thunderstorms and hail.

So far in 2022, two hailstorm episodes in France – in June and July – during the heatwave in central Europe resulted in huge losses for the insurance industry to the tune of €4 billion.

Munich Re data shows that losses caused by severe thunderstorms – also known as convective events – have risen considerably since 1980, even when adjusted for price increases and rising values.

This year’s drought in parts of Europe is now likely to occur with a 20-year frequency, he thought. ”Europe is increasingly a heatwave hotspot with a trend to more persistent heat extremes.”

“We need to really understand how the exposure of natural perils is evolving… and provide innovative solutions that enable the introduction of green technologies.”

Baden Baden: Cedants must dramatically increase retentions

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

Currently reading

Currently readingBaden Baden: Trapped capital will further dent European capacity - Munich Re

No comments yet