The broker reported many of its excess casualty clients saw an improvement in risk-adjusted margins, despite adverse litigation trends and loss development on US exposures written in soft market years.

Aon has reported its view of the 1 January reinsurance renewal, revealing that ‘favourable’ conditions for US casualty business did not reflect the concerns expressed by reinsurers in ahead of 1/1 negotiations.

The result was that reinsurance conditions for US casualty were “broadly stable…with more than ample capacity to meet demand”, the reinsurance broker said.

Aon’s “Reinsurance Market Dynamics January 2025 Renewal report” headlined with reinsurers showing ‘greater flexibility’, following a second year of strong profits.

Aon estimated global reinsurer capital was at “a new high” of $715bn as of September’s end, driven by retained earnings, with capacity bolstered by eased retrocessional conditions.

Additional capacity supplied by reinsurers was “more than sufficient to meet continued growth in global demand” in general, Aon observed, while specialty business is seen by reinsurers “as a source of diversifying growth”.

Property cedants with loss-free programmes could secure catastrophe coverage on incrementally improved terms, Aon reported.

“Ample capacity resulted in risk-adjusted price reductions, with reinsurers demonstrating increased flexibility and a willingness to meet the needs of individual insurers,” the broker said.

“Reinsurers’ desire to grow created opportunities for buyers to align coverage and purchase additional protection,” Aon continued.

Following hurricanes Milton and Helene, insured losses from global natural catastrophe events were estimated at upwards of $140bn in 2024.

“Renewal impacts were largely confined to the most affected local markets, notably Canada, Central and Eastern Europe and the United Arab Emirates,” Aon added.

Casualty entrants

Aon acknowledged that the US casualty segment was “a topic of significant concern” among reinsurers heading into the 1/1 renewal season.

Casualty loss cost trends have been “a major topic on recent earnings calls”, Aon highlighted.

“Beginning with the fall 2024 industry conferences, reinsurance executives identified adverse loss and litigation trends along with uncertainty around reserving and pricing adequacy as the primary drivers of their bearish view on the line of business,” the broker said.

“While those concerns are legitimate, the broad market response at 1/1 was tempered; favourable conditions such as supply/demand dynamics, high interest rates and a robust underlying rate environment ultimately led to stable renewals for insurers,” Aon’s report added.

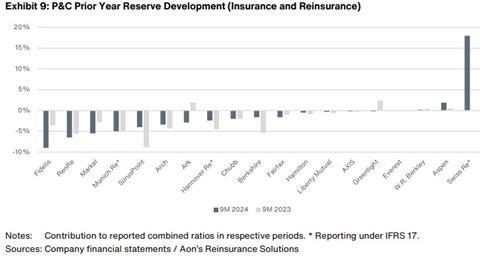

Pockets of adverse reserve development in lines most exposed to social inflation, such as general liability and commercial auto, have been widely acknowledged, but favourable development in other classes continues to mask these deficiencies in most cases, as shown in Exhibit 9, the first of the charts below.

Aon said that those reinsurers who held US casualty positions in the soft market years, defined as between 2014 and 2019, were “prudent with their capacity”.

This stance contrasted with “some newer market entrants” who Aon said “took advantage of current underlying pricing dynamics”

“In fact, many excess casualty clients saw an improvement in risk-adjusted margins, despite adverse litigation trends and loss development on US exposures written in those soft market years.” Aon said.

“Conditions were more moderate for US regionals due to the nature of reinsurance structures and higher leverage among some of these insurers. Workers’ compensation remains an attractive line for reinsurers, despite an uptick in frequency losses and a slight downward trend in underlying pricing,” the broker’s paper added.

Premium growth slowing

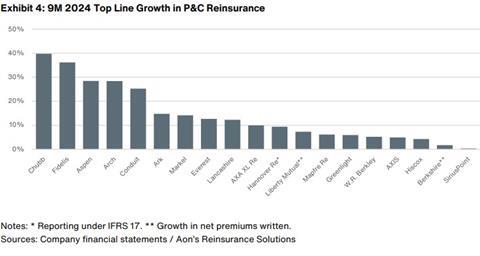

Across the sector, premium growth is slowing, with casualty concerns “weighing on momentum”, Aon observed.

Rate adequacy is “generally viewed as strong” across short-tailed property and specialty lines.

Inflationary factors continue to underpin both pricing and demand for coverage.

Segmental disclosure is limited, but most hybrid companies are growing more quickly in assumed reinsurance than in primary insurance.

The average increase is captured in Exhibit 4 of Aon’s report, shown below, at 15.4 percent.

Underwriting still in profit

“The reinsurance industry starts 2025 in a strong position,” according to Aon.

The broker said it expects reinsurance demand to remain strong in 2025, albeit at a lower growth than 2024 as inflation has moderated, with primary market trends fuelling reinsurance demand.

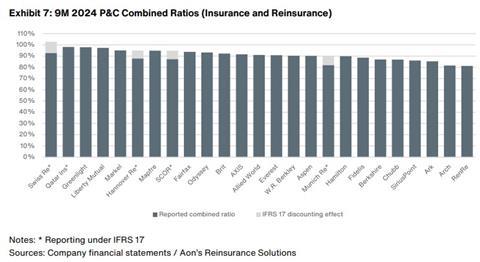

Reinsurers’ combined ratios in 2024, across 25 companies tracked by Aon, are shown in exhibit 7, the bottom chart below.

The average result ticked up by 0.4 percentage points year-on-year to 91.4%, Aon reported.

Major underwriting losses reported by reinsurers “generally remained within budget” in the last two years.

Higher retentions provided protection against record secondary peril losses, while primary peril losses have remained at manageable levels, including the impact of Hurricane Milton.

The average major loss ratio across 22 companies surveyed was 7% in the first nine months of 2024.

“We observed an increased level of appetite in high margin lines of business and regions at the January 1 renewals, driven by reinsurers that desired improved signings across a broad swath of insurer clients,” said Alfonso Valera, co-CEO EMEA at Aon’s Reinsurance Solutions.

“Many reinsurers need to revisit how they articulate and deliver value to clients in a sustainable, profitable manner, as now is the time to unleash financial and intellectual capital to help insurers grow profitably and expand their offerings to sustain a healthy market,” he said.

Tomas Novotny, co-CEO EMEA at Aon’s Reinsurance Solutions, added: “During the January renewal season, reinsurers demonstrated strong appetite for writing business in this current hard market, and most renewals resulted in meaningful over-subscriptions.

“Reinsurers are clearly trying to maximize the scale of the business written with great return-on-equity potential, and the most successful are those that are able to meet clients’ needs holistically, across their portfolios and across the board on their catastrophe programs.

“The market’s willingness to deploy its capacity in support of currently unmet need will define the sector’s long-term relevance, and we should all remember that reinsurance is not just a transaction; it’s about partnering with insurers and helping them grow, with Aon here to drive that process and shape better business decisions for all parties.”

The full Aon report can be found, here.

No comments yet