The first quarter of 2024 has also shown strong results, with up to a 12% improvement in reinsurers’ combined loss ratios, according to the reinsurance broker.

Reinsurers have built on the near record returns in 2023 with a strong start to this year, according to Gallagher Re, although the broker also suggests the market has also moved in buyers’ favour.

Last year many reinsurers achieved a return on equity (ROE) exceeding 20%, and the underwriting side of the business has more than done its part to repeat this profitability, with up to a 12% improvement in combined loss ratios.

This is according to Gallagher Re’s “1st View report”, released today.

These positive outcomes can be attributed to several factors, the reinsurance broker said, including benign natural catastrophe activity, adjustments in the reinsurance market, improved conditions in primary markets, and higher reinvestment rates.

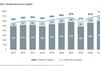

This has created a more favourable market for reinsurance buyers, Gallagher Re said, with sufficient capital to meet increased demand.

Non-life Insurance-Linked Securities (ILS) capital reached a record level $107bn at year end 2023 and continued to grow in the first six months of 2024, driven by successful cat bonds and increased investor interest. However, new capital in the form of rated entities is limited.

Tom Wakefield (pictured), Gallagher Re CEO, said: “This more comfortable market for buyers has been underpinned by an increasing supply of capital to meet increased demand as reinsurers balance sheets have expanded on the back of strong 2023 and Q1 2024 results.”

Property lines softened

Property business has become more competitive, Gallagher Re claimed, with some pricing improvements for buyers, following the steep rises in 2023.

Buyers of property catastrophe insurance have been able to negotiate better terms and conditions on their reinsurance contracts due to the “risk on” approach taken by reinsurers, the reinsurance broker said.

Risk-adjusted catastrophe placements remaining “flat to down -10%”, the broker said, with the greatest pricing pressure on more remote layers.

Reinsurers have been more willing to adjust premiums rather than the structure of the contracts, Gallagher Re said.

Reinsurers have not been significantly affected by natural catastrophe losses in the first quarter of 2024, despite economic losses of $43bn, generating insured losses of $20bn.

The latter have primarily been driven by severe convective storms (SCS) and other so-called secondary perils for reinsurers, such as wildfires, droughts, and floods.

Unexpected flood losses in the UAE, Southern Germany, and Brazil in the second quarter of 2024 have reinforced reinsurers’ discipline in retaining risk, “with no signs of flexibility”, Gallagher Re said.

The demand for additional capacity, including an extra $3-5bn for Florida, has been met, according to the broker.

Predictions of an active 2024 North Atlantic Hurricane season have not significantly affected the pricing and capacity of traditional reinsurers, according to the report.

However, some ILS capacity, industry loss warranty (ILW) capacity and retrocession capacity providers have moderated their appetite for US and Caribbean catastrophe exposure.

Casualty confidence lacking

In the casualty insurance sector, reinsurance underwriters are “not as confident” as their counterparts in the property insurance sector, according to Gallagher Re.

Concerns over rate adequacy in the US have increased, following adverse development reported by liability insurers in the fourth quarter of 2023 and first quarter 2024.

The lengthening and deteriorating tail of liability claims have exacerbated reinsurers’ concerns, as the market is already dealing with economic and non-economic loss inflation.

“While supply and demand dynamics remain stable with adequate capacity, there have been some minor changes in reinsurer panels, indicating a lack of consensus on the underlying issues and how to address them,” Gallagher Re said.

Specialty lines orderly

In the specialty lines sector, reinsurers have maintained underwriting discipline, resulting in no capacity constraints for reasonably priced and structured programmes, except for ultimate net loss (UNL) retrocession.

Certain individual lines, such as medical excess, have experienced substantial rate increases due to class-specific issues, Gallagher Re reported.

However, these rate increases are specific to the class and are not correlated with other specialty lines or the wider property and casualty lines of business, the broker said.

In broad term, market has “achieved a balance” between supply and demand, according to the intermediary.

“Reinsurers are currently maintaining a balance between revenue growth and profit margins,” Wakefield said.

“There is no evidence of any major reinsurer deviating from this approach to drive top-line growth through looser underwriting and pricing,” he added.

No comments yet