Non-loss-impacted property catastrophe renewals fell 5-15% risk-adjusted at 1/1, the broker said, but casualty reinsurance buyers experienced ”varying outcomes”.

Guy Carpenter has released its take on the 1/1 reinsurance renewal, headlining a risk-adjusted drop in property catastrophe reinsurance pricing of between 5% and 15%.

This fall in rates for the industry’s bellwether segment came amid “strong reinsurer appetite” and excess capacity for “consistently oversubscribed” property catastrophe business, the reinsurance broker reported.

However, the broker described “continued reinsurer discipline around…attachment points and pricing” for property catastrophe programmes.

The broker also emphasised “meaningful cedent actions” to improve underlying portfolio profitability through rate improvement, limit management and “disciplined risk selection”.

In contrast to the broader property catastrophe market, loss-impacted layers saw adequate capacity with risk-adjusted rates from flat to 30% increases in regions such as the US, Europe and Canada, the broker noted.

President and CEO of Guy Carpenter, Dean Klisura (pictured), said: “It is critical that reinsurers take a long-term view and are constructive partners for our clients.

“Renewal outcomes at year-end reflect reinsurers’ positive property experience over the last two years and casualty portfolios that are well-positioned for future profitability.”

Casualty concern

A “challenging casualty market” provided an island of robust pricing discipline for reinsurers, Guy Carpenter acknowledged.

“An area of market concern”, year-end casualty reinsurance renewals were completed “with varying outcomes”, according to Guy Carpenter.

Proportional casualty structures generally experienced ceding commissions that were “flat to slightly down”, the intermediary said.

However, excess of loss general liability and excess/umbrella placements “continued to face pressure on treaty terms”.

Cedents considered the value of casualty reinsurance by “weighing cost and structure options”, in common with property purchases, the broker suggested.

Clients provided additional claims, rate, and exposure data, the broker said. This increased transparency helped distinguish client portfolios and allowed reinsurers “to gain comfort” with treaty terms.

The cyber reinsurance market meanwhile remained dynamic and innovative, with buyers exploring a range of blended solutions, from pro rata to event excess of loss and aggregate stop loss structures.

Overall, cedants continue to manage reinsurer partnerships holistically, the broker emphasised, trading across product lines and treaties, “critical in the current environment where market conditions vary across property and casualty lines”.

Rosy ROEs

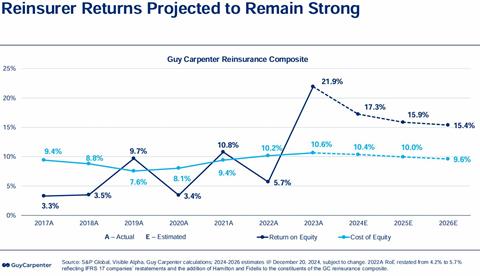

Reinsurers enjoyed “another profitable year” in 2024, featuring projected average reinsurer returns on equity (ROE) of 17.3%, according to Guy Carpenter’s proprietary reinsurer composite calculation.

The broker suggested the ROE outlook would continue to be strong for reinsurers.

Total dedicated reinsurance capital is up by 6.9% to $607bn, based on data from the broker and credit ratings agency AM Best.

Profits and retained earnings continue to drive continued growth in dedicated reinsurance capital, the broker said – see the first of the charts below.

Guy Carpenter added that it expects reinsurer returns to remain strong – putting out 15.9% and 15.4% expectations for 2025 and 2026, respectively – see the second chart below.

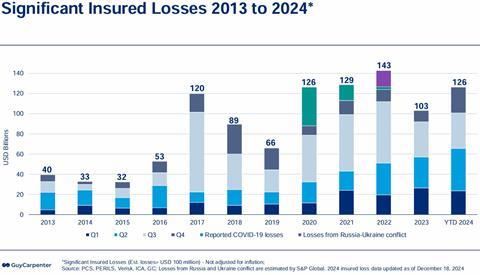

The above is, of course, subject to claims activity – with property catastrophe a volatile source of unpredictability – the third chart below charts insured losses over the past decade.

Cat bond activity robust

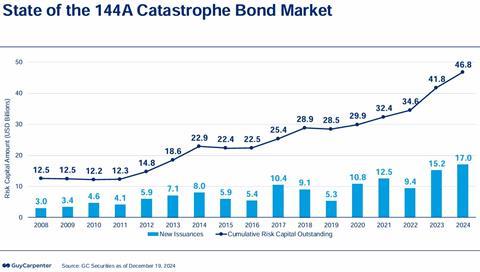

Activity in the 144A catastrophe bond market remained robust at year end, with 67 different catastrophe bonds brought to the market for approximately $17bn in limit placed in 2024.

The last of the charts below shows “the state of the market” for standard 144A cat bonds, revealing $46.8bn of risk capital in play as of the end of 2024

In contrast to the broader property catastrophe market, Guy Carpenter observed loss-impacted layers saw adequate capacity with risk-adjusted rates from flat to 30% increases in regions such as the US, Europe and Canada.

No comments yet