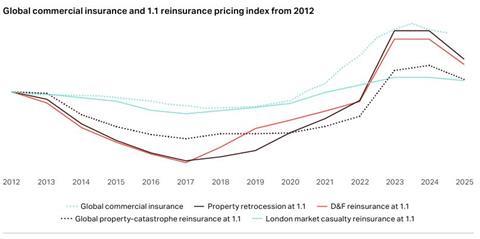

Risk-adjusted price reductions at January renewals included retrocession down 13.5%, D&F down 12.5%, global property cat down 8% and London market casualty XoL down 2%.

Howden’s report on the 1 January reinsurance renewal is entitled “Past the Pricing Peak” and outlined a slew of rate reductions observed by the broking group across lines of reinsurance business.

After “an extended period” of rate increases across the re/insurance sector – driven by accumulating and intersecting crises, capital constraints and cyclical adjustments – Howden said the availability of deployable capacity in the marketplace signalled “a new phase in the cycle” and a shift from the recent past.

Market performance “remains robust”, Howden said, backed up by an “attractive underwriting environment”.

In most lines of business, buyers can expect favourable market conditions “to persist in 2025, barring any market-disrupting events”, Howden said.

Favourable supply dynamics became increasingly evident across both the commercial insurance and reinsurance markets over the last 12 months, the broker said.

These dynamics played a pivotal role in the 1 January 2025 reinsurance renewals, “fostering competition that led to risk-adjusted rate reductions in several areas”.

Pressure on pricing was also evident in primary markets for commercial insurance globally, Howden noted, with pricing across all lines of business renewing at -0.9% in 2024, the first negative reading since 2017.

“Our report is something of a wake-up call for the industry,” said David Howden, founder and CEO of Howden.

“The dawn of a new cycle presents fresh opportunity as insurers look for new business to drive growth. In a more volatile world, our clients are crying out for more protection in everything from cyber to renewables,” he continued.

“So the stars are aligning. Greater emphasis on innovation, on collaboration and on listening to the needs of the customer will mean a win-win-win for clients, society, and insurance companies alike,” Howen said.

“The re/insurance market continues to present significant opportunity for growth, said Tim Ronda, CEO of Howden Re, the group’s reinsurance broking arm.

“Companies across the sector are executing strategies that not only meet their cost of capital but, in many cases, exceed return hurdles. Investors should view the sector as one rich with growth potential and attractive opportunities,” he added.

Selected charts from the report appear at the bottom of this article. The full report can be found here.

Property cat

Rate on line in the headline property catastrophe market was down by 8%, risk-adjusted, the broker said, against last year’s 3% rise.

Demand was strong once again, driven by higher exposures and asset values, and increased appetite across traditional and alternative markets drove an even bigger increase in supply.

Expectations for US rate reductions in property-catastrophe renewals “ultimately held true”, despite initial uncertainty around damage caused during 2024’s hurricane season.

The report said: “Despite another year of elevated catastrophe loss activity, compounded by the relatively late arrivals of Hurricanes Helene and Milton, favourable market conditions helped insurers to navigate the uncertainty around loss quantum to see property-catastrophe placements over the line, typically with sizeable rate decreases.”

Favourable conditions for buyers typically prevailed, resulting in risk-adjusted price decreases ranging from down 7.5% to down 15%.

Loss experience played a pivotal role in shaping European property-catastrophe renewals at 1 January 2025,Howden said.

“Loss-free programmes secured rate reductions averaging between down 3% and down 15%, while loss-affected regions experienced significant upward pricing adjustments following recoveries,” the broker said.

Global casualty

Casualty reinsurance renewals at 1 January 2025 were marked by “significant differentiation”, Howden said.

In the US, “heightened scrutiny of litigation risks” and loss cost trends shaped the market.

The broker said outcomes at renewal were largely driven by individual portfolios’ loss experience, underlying rate changes and reserve development.

International renewals benefitted from “abundant supply” and strong underlying fundamentals, according to the broker, evident in the “smooth execution” of placements.

Property retro

The retrocession market saw “another profitable and largely loss-free year” in 2024, creating pressure on prices and signings at renewal.

The impact of Helene and Milton was limited, Howden noted. Consequently, risk-adjusted pricing fell by between 10% and 20% on average at 1 January 2025.

Direct and facultative (D&F)

The global D&F market delivered another strong performance in 2024, Howden said.

Risk-adjusted pricing was typically down by 10% and 15% on average at 1 January 2025 renewals, with claims from Helene and Milton below retention levels “barely impacting” cedants.

Howden said 2024 “underscored the D&F market’s resilience” amid heightened cat activity and “historically elevated pricing”.

Specialty Re

“Despite elevated geopolitical risks and ongoing uncertainty surrounding war-related losses from active conflicts, several specialty lines performed strongly, achieving risk-adjusted rate reductions at the 1 January 2025 renewals,” Howden observed.

Marine and energy, cyber, aviation and war, political violence, and terrorism lines all benefitted from “strong results in underlying portfolios and ample capacity”, shifting conditions in favour of buyers, according to the broker.

“In contrast, the trade credit and political risk market continued to face capacity constraints, with renewals seeing only modest changes to pricing and terms across both excess-of-loss and pro rata programmes,” Howden said.

Ronda said: “Encouragingly, our clients are beginning to see relief from the pricing pressures of the last three years in several segments. Even with this relief, we believe that end risk-takers can continue to generate strong returns and provide a stable and long term source of efficient capital.

“This market environment creates an ideal space for an innovative organisation like Howden to develop new reinsurance products and structures, leveraging available capacity to benefit both clients and the industry - which is positioned for all participants to thrive. Over the next 12 months, we look forward to continuing our success in adding value for clients through an increasingly heightened macro risk landscape,” he added.

Outlook for 2025

Pricing is beginning to decline from historically high levels, but structural changes introduced during the hard market are likely to endure, the broker suggested.

Insurers are expected to face continued earnings volatility in 2025, as they absorb the majority of catastrophe losses – particularly from severe convective storms, floods and wildfires – due to persistently high attachment points.

David Flandro, head of industry analysis and strategic advisory, Howden Re, said: “The transition from peak pricing continues to offer fertile ground for those able to leverage data, analytics and innovation.”

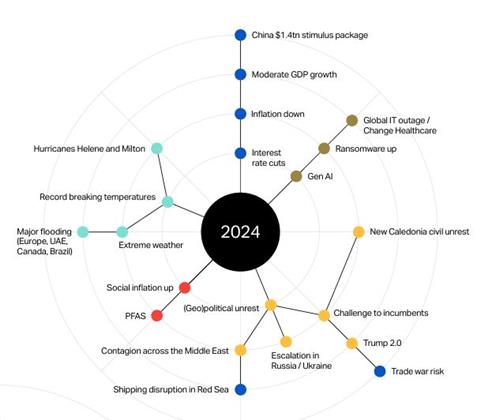

The risk landscape remains unyielding, Howden warned.

Devastating and escalating wars, commodity shocks, soaring prices, financial market instability and high debt levels have ushered in a “fragmented global order with profound implications for security, commerce, investment, supply chains, and political stability”, the broker noted.

This new reality places businesses and carriers in a persistently high-risk environment, with the potential to intensify further, said the report.

If 2024 will be remembered for escalating conflicts, the ‘biggest election year ever,’ and economic divergence, 2025 is poised to be shaped by policy implementation (tariffs and trade) and the emergence of new cycles, according to the broker.

Flandro added: “Market trends are unfolding in an environment of buoyant reinsurance capital set against a growing spectrum of risk, amidst a backdrop of increasing macroeconomic and geopolitical uncertainty.

“These interconnected dynamics underscore the critical importance of understanding the full breadth of market cycles and capital flows. At Howden Re, we are uniquely positioned to provide the insights and strategies our clients need to navigate this complexity, ensuring resilience and success throughout the cycle.”

No comments yet