Hurricane Milton will cost insurers and reinsurers somewhere in the range of $22-$36bn, according to Moody’s RMS Event Response.

Moody’s RMS Event Response has estimated the total private market losses from Hurricane Milton to be between $22bn and $36bn, with a best estimate of $26bn.

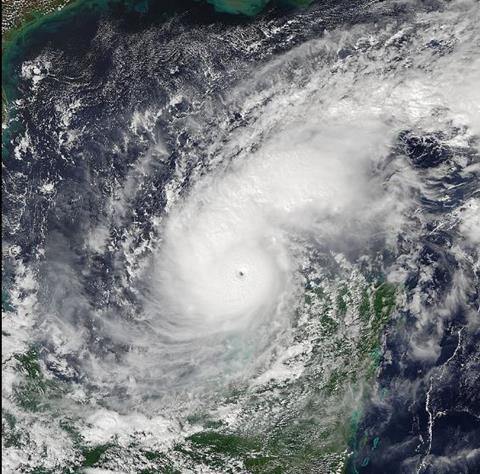

Milton was the thirteenth named storm of the 2024 North Atlantic hurricane season, the fifth hurricane to make landfall in the US this season, and the third to make landfall in Florida.

Milton made landfall as a Category 3 major hurricane near Siesta Key, Florida on October 9. At landfall, Milton had maximum sustained winds of 120mph (193kph) and a central pressure of 954 hPa.

Moody’s RMS Event Response said it expects private market losses for Milton to be largely driven by wind, with smaller contributions from storm surge and inland flood impacts.

Total private market insured losses for Hurricane Helene, which struck two weeks earlier, and Milton, combined, are to be between $30bn and $50bn, according to Moody’s RMS, some $5bn down on a previously published combined estimate for the two storms.

The catastrophe risk modelling firm’s estimates reflect insured wind, storm surge, and inland flood impacts.

Additionally, Moody’s RMS Event Response estimates losses to the National Flood Insurance Program (NFIP) across both events could exceed $5bn.

NFIP losses are expected to be largely driven by storm surge, particularly in areas south of Tampa Bay-St Petersburg. Insured wind and NFIP losses will be driven by residential lines, while storm surge and inland flood losses to the private market will be driven by commercial, and automobile lines, the cat modeller said.

“We were fortunate to avoid the ‘grey swan’ event that many feared when Milton tracked and made landfall south of the Tampa-St Petersburg metro area,” said Mohsen Rahnama, chief risk modelling officer, Moody’s.

“Still, the storm’s large swath of damaging winds, subsequent storm surge, and inland flood footprints affected key exposure areas throughout the state, which will undoubtedly make it one of the costliest hurricanes to impact west Florida,” Rahnama added.

| Private Market Insured Loss | Wind (incl. coverage leakage) and storm surge excl. NFIP | Inland Flood excl. NFIP | Total | Best Estimate |

|---|---|---|---|---|

|

Helene |

$7-12bn |

$1-2bn |

$8-14bn |

$11bn |

|

Milton |

$21-34bn |

$1-2bn |

$22-36bn |

$26bn |

|

Combined |

$28-46bn |

$2-4bn |

$30-50bn |

$37bn |

Jeff Waters, director, North Atlantic hurricane models, Moody’s, said: “Alongside damaging wind, storm surge, and precipitation-induced inland flooding, the outer rainbands of Hurricane Milton also produced numerous damaging tornadoes across Florida.”

“Damage surveys by the National Weather Service are still being conducted, but even the confirmed data to date suggests that Milton produced one of the most prolific tornado outbreaks associated with a tropical cyclone in recent history.

“Moody’s RMS Event Response used insights from our own in-person reconnaissance and remote sensing data to analyze these tornado tracks and associated wind speeds. This data is incorporated into our wind reconstructions and overall industry loss estimate for Milton,” Waters said.

Raj Vojjala, managing director, modelling and analytics, Moody’s, said: “It’s important to not just consider the overlap across areas affected by high winds and surge in Milton and Helene, but also areas that sustained damage during Hurricane Ian in 2022 that haven’t fully recovered yet.

“Our vulnerability experts on the ground surveyed these impacts firsthand, which was invaluable in discerning the loss potential from Milton. Field reconnaissance confirmed numerous instances of improved resilience of structures that had their roofs replaced recently.

“It also highlighted areas with older building stock and roofs in parts of Tampa Bay that had not experienced such high winds in recent times, which will likely drive notable wind claims in Milton, especially if they are subject to the Florida 25 percent roof replacement rule,” Vojjala added.

No comments yet