Intelligent technologies will transform the automotive landscape over the coming decades, according to rating agency Moody’s.

Autonomous vehicles will drive the transformation of the motor / auto insurance market, according to a new report from Moody’s Investors Service.

Personal and commercial auto insurers will initially benefit from fewer accidents, the rating agency argued.

However, the same insurers face long-term risks that autonomous vehicles will reduce the need for auto insurance, according to the report.

Autonomous vehicles are on the horizon, but adoption will take time, Moody’s emphasised.

Vehicles with Level 2 autonomy (partial automation, with constant driver supervision) are already available for the public from many automakers, and Mercedes-Benz recently won approval for Level 3 autonomy (hands-free driving under certain conditions).

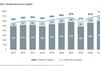

Autonomous taxis are already in service. Autonomous technologies will continue to improve, and Level 3+ autonomous vehicle sales will increase over the coming decade. Given that the average vehicle age in the US is about 12 years old, a shift in the vehicle fleet to full autonomy could take decades, the ratings firm suggested.

Autonomous vehicles and other intelligent technologies will initially boost auto

insurer profitability, according to Moody’s.

“Autonomous and other intelligent auto technologies will significantly reduce the frequency of accidents, which will boost insurer profitability. Although US auto insurers have posted weak earnings over the last two years because of higher auto repair costs and used vehicle prices, we expect that as intelligent technologies get better, insurer loss costs will gradually decline,” Moody’s said.

Long term, Moody’s expects autonomous vehicles could dramatically reduce premiums and profits for auto insurers.

As advanced autonomous vehicles become prevalent, accident frequency is likely to fall precipitously over time, and could ultimately translate into significantly lower loss costs and premiums for auto insurers.

Profits are likely to also decline, since most insurers set profit targets as a percentage of premiums, Moody’s warned.

Auto liability could shift, but limited demand for auto insurance will remain, the ratings firm said.

“Regulators, lawmakers and courts will have to determine how liabilities for accidents caused by autonomous vehicles are shared among automobile manufacturers, technology companies, drivers, and their insurers,” Moody’s said.

Some, albeit smaller, demand for specific auto-related insurance coverages such as product liability for automakers, could remain, the company suggested.

Insurers have time to respond to these shifts, Moody’s underlined.

“Because changes to the auto insurance industry will be gradual, we believe innovative insurers will be able to adapt their operations and balance sheets to these changing circumstances. Fundamental credit strengths, including innovation, adaptability, and strong financial metrics, help offset long-term risks.”

Commercial auto faces different challenges

There are several unique factors that could speed up, or slow down, the adoption of autonomous vehicles for commercial uses, Moody’s argued.

Waymo autonomous taxis are available in San Francisco, Phoenix, and soon Los Angeles, while Cruise autonomous taxis are only available in San Francisco.

All three are cities offer moderate density and mild weather. It is unclear when autonomous taxis will be available in denser cities with challenging weather conditions (including snow), such as New York.

“Once autonomous long-haul trucks become available, trucking companies could be under economic pressure to replace their fleets with autonomous trucks given lower operational costs of drivers’ wages, less required downtime due to driver fatigue, cheaper insurance costs, lower wear-and-tear on the vehicles, and better fuel economy algorithms,” Moody’s said.

However, Moody’s expects resistance from labour unions and from professional drivers, which make up over four million jobs in the US.

“Given the high damage that a long-haul truck can cause in an accident, driver oversight will likely be required for many years. Truck drivers also watch over valuable cargo to protect it from theft or vandalism,” Moody’s said.

As these jobs are eliminated, there could also be reduced demand for workers’ compensation insurance, the rating agency warned.

No comments yet