Gallagher Specialty released the Q1 iteration of its structured credit and political risk study, highlighting shifts in economic and foreign policy since Donald Trump’s second inauguration.

Structured credit and political risk capacity has risen among insurance market carriers, according to broker Gallagher Specialty, which has released its biannual Structured Credit and Political Risk (SCPR) Insurance Market Report.

The broker noted the SCPR insurance market’s “pivotal role in safeguarding investments and facilitating trade” in a “dynamic geopolitical landscape”.

It remains proactive and agile as it faces new types of risk in increasingly challenging jurisdictions.

Geopolitical frictions, notably across the Middle East and Africa, and the shift in economic and foreign policy following Donald Trump’s second inauguration, “are certain to continue influencing trade and investment opportunities”, the broker emphasised.

The fallout is that corporates and investors will need to remain vigilant whilst adapting their risk management strategies to navigate these evolving challenges effectively — SCPR insurance is becoming an increasingly vital tool for these companies.

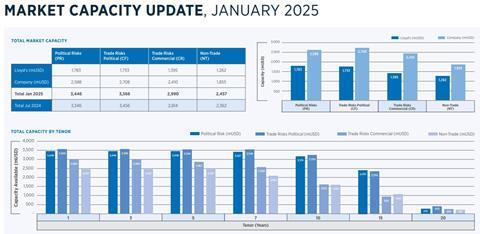

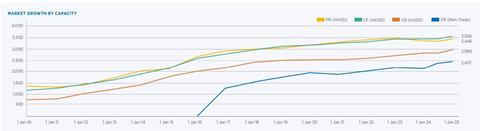

Capacity has grown again with more insurers capable of writing long-term risks than ever before to accommodate “rising demand for the product”, Gallagher said.

This growth is clearly illustrated in the report’s market capacity section (charts below), where for political risks and contract frustration, around $3.5bn of capacity is available.

“To accommodate rising demand, capacity has grown once again with more insurers than ever before capable of writing long-term risks,” Gallagher said.

The report is written in conjunction with consultancy Pangea-Risk, with country summaries focusing on a handful of territories with changeable risk profiles, focusing on Türkiye, Saudi Arabia, Ivory Coast, Egypt, and the Democratic Republic of Congo.

“With new types of risks emerging in increasingly challenging jurisdictions, the SCPR insurance market remains proactive, innovative and agile – primed to play a pivotal role in safeguarding investments and facilitating trade,” said Gallagher.

“Corporates and investors need to stay vigilant and ready to adapt their risk management strategies to navigate these evolving challenges, such as the geopolitical frictions we are seeing across the Middle East and Africa and shifts in economic and foreign policy since Donald Trump’s second inauguration,” the broker added.

The full report can also be accessed here.

No comments yet