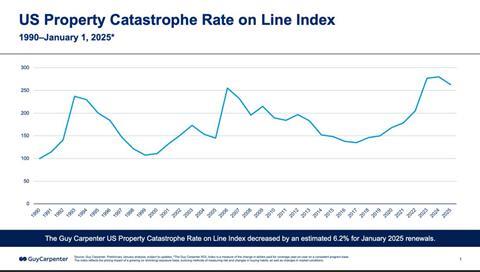

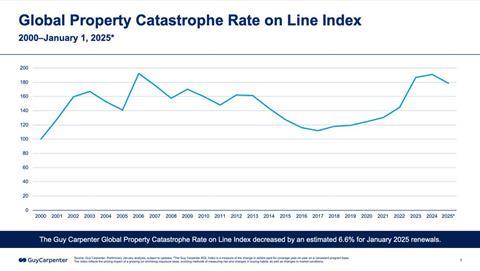

The reinsurance broker released its rate-on-line indices for property catastrophe business at the 1 January reinsurance renewal, headlined by a US decrease of 6.2% and an overall fall of 6.6% globally.

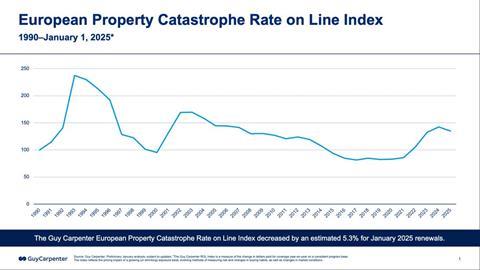

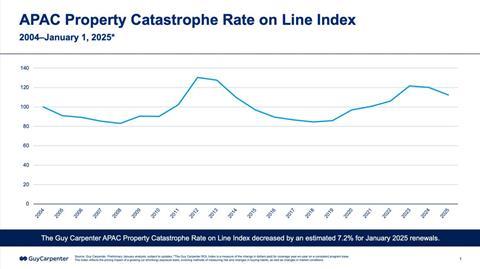

Guy Carpenter’s 1/1 rate-on-line (ROL) indices for the 1/1 reinsurance renewals show a decline across regions globally for property catastrophe treaty business.

The biggest market, for US property cat business, decreased 6.2% at January’s reinsurance renewals.

ROL represents the cost of reinsurance based on premium as a percentage of limit.

The ROL for European property cat business fell by 5.3%; Asia Pacific cat treaties renewed with the biggest drop in pricing, the ROL dropping by 7.2%.

Globally, the ROL decreased 6.6%, said Guy Carpenter, which is the reinsurance broking arm of Marsh McLennan Group.

“These indices will continue to be updated at key renewal dates throughout 2025,” Guy Carpenter said.

The reinsurance broker released its data (charts below) after its main analysis of the 1/1 renewal, summarised here.

“Each Guy Carpenter ROL index is a measure of the change in the amount paid for coverage year on year on a consistent program base,” Guy Carpenter said.

“Each index reflects the pricing impact of a growing (or shrinking) exposure base, changes in buying habits and the way risk is measured, as well as changes in market conditions,” the broker said.

“Unlike risk-adjusted measurements, each index is not dependent on the model or method used to measure the amount of perceived risk in a program, which can vary widely,” Guy Carpenter added.

No comments yet