AM Best’s DuPont analysis indicated reserve leverage for the composite dropped, led by non-life reinsurers, other than the ‘big four’, whose reserve leverage was relatively stable.

AM Best has updated its analysis on the financial performance of non-life reinsurers, highlighting gains made in 2024 return on equity (ROE) numbers, due to positive underwriting and investment results.

The rating agency’s DuPont analysis for 2023 indicated that reserve leverage for the composite dropped, led by non-life reinsurers, other than the so-called ‘big four’ reinsurers, whose reserve leverage was relatively stable.

The fall in reserve leverage was offset by a significant increase in operating margins, AM Best said.

Principal Takeaways:

- The considerable improvement in the return on equity of AM Best’s “Top 25 Global Reinsurance Composite” was due to net investment income, underwriting gains, and unrealized capital gains.

- Net investment income led the contribution to surplus growth, followed closely by underwriting gains and unrealized capital gains. These three components pushed ROEs well above the cost of equity capital.

- Net investment income remains a key way to increase surplus and compound returns on equity capital, as underwriting margins tend to be relatively low on average.

In 2023, a year in which premium rates continued to move up, interest rates remained high, and capital markets performed well, so that AM Best’s composite recorded its highest ROE in five years – a 22% aggregate figure.

“Secondary” natural catastrophe events “were the norm” in 2023, but reinsurers’ ROEs reflected their move away from the lower levels, taking attachment points that insulated them from these claims events, a higher proportion of which were retained by cedants.

These higher attachment points still apply when considering the cost of recent hurricanes Helene and Milton, AM Best noted, leading to an expectation of “manageable losses”, with a combined figure in the $25-50bn for both storms combined.

“AM Best considers the impact of the two hurricanes to be more of an earnings rather than a capital event,” the report said.

Underwriting income was key to the rise in ROE observed in 2023, but “lost participation in the total return on investments”, which include unrealised capital gains.

Given investment allocations and risk profiles, AM Best said it “continues to see underwriting profitability as the essential in the composite’s operating performance”.

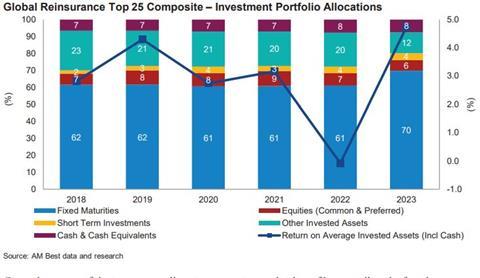

Fixed maturity investments – i.e. the top rated government and corporate bonds – represent a bigger share of reinsurers’ asset portfolios (see chart), caused by rising interest rates in 2022, consolidated into portfolios in 2023.

“AM Best sees a shift to a more defensive portfolio, with high liquidity, shorter durations, and high credit quality investments as beneficial to the composite’s operating performance and balance sheet strength assessments over the short to medium terms,” the paper added.

No comments yet