Conflict in Ukraine has potential to become an ’industry-defining event’ for the global renewables re/insurance sector

The conflict in Ukraine has the potential to become an industry-defining event for the global renewables re/insurance sector, according to a briefing from Verisk’s PCS.

In addition to the estimated industry-wide insured losses from windfarms reaching at least US$800 million in aggregate, solar energy insured losses could begin to arise, as well.

Although it is still difficult to assign an industry-wide insured loss estimate, the role of solar energy in Ukraine’s renewables sector and the extent of reported damage suggests profound implications for re/insurers of renewables.

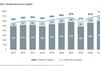

Ukraine’s energy mix features fossil fuels heavily, particularly coal and natural gas, followed by nuclear power, which accounted for almost a quarter of the mix in 2018. By 2020, renewable energy rose from 5 percent of the country’s mix in 2018 to 12.4 percent.

As of the end of 2020, solar dominated Ukraine’s renewable energy mix with a 78 percent share, followed by wind at 20 percent, according to some loose PCS research and calculations.

The region in Ukraine where the conflict is centered is also where most of the country’s renewable energy capabilities are located. In fact, 66 percent of Ukraine’s renewables are located in: Odesa, Zaporizhzhia, Mykolaiv, Kherson, and Dniepro.

Further, 60 percent of solar power capability is in conflict “hotspots,” amounting to 3,770 MW of installed capacity. Thirty-eight of 42 windfarms are located in the region stretching from Odesa to Luhansk.

“Considerable damage” to solar

As a result, the risks of loss in the renewable energy sector have been pronounced, and already, it appears that kinetic activity has led to potential industry-wide insured loss activity.

According to Kosatka.Media, the damage caused to Ukraine’s solar energy sector by the conflict has been considerable, beyond what PCS has estimated separately both for the renewable energy sector and the broader conflict. For the global re/insurance industry, there is an expectation of significant loss activity.

PCS does not have an estimated industry-wide insured loss yet for the solar sector in Ukraine. While there is a sense that the potential for physical damage and business interruption insured losses could be high, based on client conversations, any estimates would likely not be proportional to solar’s share of Ukraine’s energy mix.

The accumulation of insured specialty lines losses provides a unique set of challenges for the global re/insurance industry, particularly if the event exceeds an aggregated $20 billion (inclusive of insured losses related to leased aircraft) – an estimate that could continue to develop as the conflict continues. The discovery of additional categories of insured loss could push that number higher, as well.

The role that insurance plays in post-conflict rehabilitation becomes an important illustration of the need for insurance worldwide. Insurance contributes to post-event recovery, whether from natural or man-made events.

”The conflict in Ukraine fits into a broader worldwide political violence trend for the global re/insurance industry, following annual multi-billion-dollar losses back to 2019,” believes PCS.

”Rather than look at the past four years as a series of one-off events, it’s time to take the trend at face value and better understand political violence risks as they relate to the global re/insurance industry and develop more robust approaches to risk transfer.”

No comments yet