A competitive reinsurance market saw “much improved pricing” for most buyers at the key 1 April renewal for Japan, South Korea and India, the reinsurance broker reported. Notably, the LA wildfires had little effect beyond loss-hit US insurers, according to Aon.

Aon has said the 1 April renewals was positive in that it favoured buyers of reinsurance and “bodes well for upcoming mid-year renewals”.

Despite headwinds, the reinsurance market is “highly capitalised and competitive ahead” of mid-year renewals, according to the reinsurance broker.

The broker’s “Reinsurance Market Dynamics April 2025 Renewal” report said it expects “buyer-friendly conditions will prevail, supported by robust levels of capacity and reinsurer appetite”.

George Attard CEO, Asia Pacific Reinsurance Solutions, Aon, said the experience on 1 April was “beating expectations”, writing in the paper’s executive summary.

“Following relatively benign natural catastrophe loss activity in Asia, reinsurers deployed additional capacity at 4/1. As a result, insurers enjoyed healthy reductions, particularly in Japan and South Korea, where risk-adjusted property catastrophe rates achieved double-digit reductions,” he observed.

Previously challenged areas, such as per-risk covers, also enjoyed more favourable pricing, he suggested, as insurers leveraged property catastrophe business and reinsurer growth ambitions to garner more holistic support.

The Los Angeles wildfires in January, which are expected to cost the industry between $32bn and $38bn, “had little to no impact on capacity, pricing and terms for Asia Pacific renewals”, according to Attard.

“For the relatively small and diverse group of US regional and national insurers renewing at 4/1, the Los Angeles wildfires had a mixed results based on wildfire exposure and loss experience,” he wrote.

“That said, US insurers with loss-free risks saw rate reductions in line with 1/1, while loss impacted accounts experienced an orderly and stable renewal. Reinsurers continued to trade and deploy capacity uninterrupted, with continuing support for insurers with significant wildfire exposure. Some reinsurers stepped up to offer additional wildfire capacity and were rewarded with larger signings,” Attard added.

Capacity ahead of mid-year renewal

June and July are key renewal dates for insurers in the US, Australia and New Zealand, which along with Japan, are among the world’s largest markets for property catastrophe reinsurance.

Despite an active first quarter for catastrophe losses, Attard expected favourable conditions seen at January and April renewals to continue at mid-year, supported by the weight of reinsurance capacity and unfulfilled reinsurer appetite.

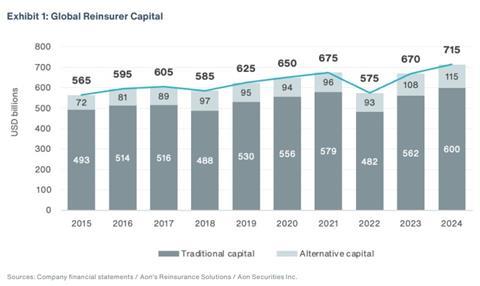

According to Aon estimates, global reinsurer capital reached a new high of $715bn in 2024, driven by strong retained earnings and an expanding catastrophe bond market.

This year has seen the first major new reinsurance players established since the market turned in 2023, with start-ups launched in both Bermuda and London, Aon noted.

In addition, outstanding catastrophe bond limit has grown to nearly $50bn as of Q1 2025.

“Reinsurance capital continues to grow and keep pace with increasing demand,” Attard said.

Heading into the mid-year renewals, we expect over $7.5bn of additional US property catastrophe limit demand, mostly due to a healthier Florida market and the depopulation of the state windstorm insurer Citizens.

“We also anticipate some additional reinsurance purchasing from US national carriers looking to mitigate further major net losses during 2025,” Attard added.

Japan particularly competitive

April 1 is the key renewal period for Japan, with more than 95% of reinsurance renewing, including some of the world’s largest catastrophe programmes, Aon’s report emphasised.

“With ample capacity and healthy reinsurer appetite, Japan’s insurers enjoyed a successful renewal, with price reductions across almost all lines. Despite devastating US wildfires in January, the property catastrophe reinsurance market in Japan was particularly competitive, with low double-digit rate reductions at 4/1,” Attard said.

“Property catastrophe rates in Japan are now comparable to 2022, just before the global re-pricing of catastrophe risk in 2023. On the other hand, structural changes implemented in 2023 have remained largely unchanged,” he wrote in the report.

Insurers were also able to leverage competition for property catastrophe business to secure more favourable pricing for non-catastrophe property, casualty and specialty lines, Attard explained.

“Reinsurers that took a holistic approach and were able to support clients’ broader needs, were in a more advantageous position at the April renewal,” he said.

“While price competition increased, terms and conditions were largely unchanged. However, several of Japan’s largest insurers moved to increase deductibles at 4/1, and some also opted to purchase additional cover at the top end of [cedants’ reinsurance] programmes.

“The increase in deductibles, along with rate reductions, has reduced the overall size of the property catastrophe premium pool in Japan at a time when most reinsurers are looking to grow,” he added.

No comments yet