Some 80% of risk leaders concerned about their organisations’ emerging-risk resilience in the next decade, according to a new WTW survey.

Only one in five key decision makers and the teams supporting them believe their organisation will be able to respond adequately to risks that might emerge in the next decade, according to a new study from broker WTW.

Only half of respondents were confident that their organisation’s approach enables it to respond to today’s risk environment, according to WTW’s Emerging and Interconnected Risks Survey.

The survey report assesses the key emerging risks identified by 333 respondents from 55 countries, with a particularly strong representation from the transportation, financial institutions and natural resources sectors.

Collectively, these organisations surveyed employ an estimated 1.3 million people and create $2.3 trn in revenue. Three types of employees were consulted: senior leaders, teams supporting senior leaders and charged with implementing action and wider employees.

“We are witnessing a continual evolution of threats, which means we need a smarter way to think about emerging risks. Every single risk in our survey was someone’s top risk, which shows there’s a real need for enhanced understanding a wide range of interconnected risks,” said Lucy Stanbrough, head of emerging risks, WTW Research Network.

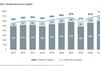

The survey was designed by the WTW Research Network to take respondents through successive stages of thinking across four lenses using a new risk taxonomy of 48 risks across eight categories.

Respondents were asked to consider the impact on their organisation of the risks of today (‘current emerging risks’), of tomorrow (‘risks that will emerge over the next two years’), of the future (‘risks that will emerge over the next 10 years’) and the interconnectivity between those risks.

Technology dominated the emerging risks agenda, WTW said, with artificial intelligence, cyber risks and the future of technology named among the top risks of today and tomorrow. Technology was also named as the greatest expected driver of change in the next 10 years.

Geopolitical issues closely followed as a top concern, as organisations highlighted a wide range of emerging risks fostering volatility, from elections to societal cohesion to the misalignment between government and business interests.

Continued amplification and acceleration of the environmental risk category dominated the longer-term view. Over the next 10 years, 47% of respondents said they expected climate change and climate transition risks to be a key source of change.

This included wider mentions of environmental degradation, the need for policy change to deal with heat risks, the arrival of tipping points, power requirements and regulation featuring alongside concerns of physical risk events.

Organisations expect to see more frequent catastrophic events and are uncertain about what that future might look like, WTW warned.

When it comes to actionable insights, 40% of respondents in the wider colleague sample say that they have never been asked to feed into their organisation’s emerging risks evaluation. One in two respondents (49%) was unable to specify the emerging risks that most concerns their organisation, despite the majority being able to identify the top five changes they expect to see over the next two (95%) and 10 years (90%).

This suggests there is opportunity to enhance internal intelligence processes through structured approaches. Action is needed to connect institutional pockets of risk intelligence and ensure a coordinated approach across the organisation. Scenarios were seen as valuable ways (43%) for organisations to tell that story and determine the appropriate strategy.

Adam Garrard, global chairman, risk and broking, WTW said: “The ability to effectively manage risk is key to thriving in an uncertain world. With regulators globally deepening their own exploration into emerging risks, investors asking more and more questions, and organisations facing material financial consequences as risks evolve, there is a need for new approaches.

“We need more than data-informed decision making to explore the emerging risks shaping risk and opportunity. We need to focus on optimising risk outcomes. Smart specialisation, smart service, smart use of data, smart research. It all comes together to help navigate the complex risk landscape,” Garrard said.

Stanbrough continued: “Organisations recognise that they are not managing emerging risks as well as they wish they were at the moment, and are focused on changing that. When we look at the actions that organisations are looking to take in the next two years, putting an emerging risk a framework in place was top of the list

“Ensuring that framework is part of the business model cannot be emphasised enough. Organisations that manage to do this successfully and find the opportunities among relentless change, will prove to be more resilient and performant,” she added.

The complete survey can be downloaded here.

No comments yet