Verisk warned conditions are “on a par” with those just before the BLM protests and riots following the death of George Floyd in US police custody, which cost approximately $3bn in insured losses in 2020.

But as we draw closer to 5 November, the potential for political violence in the form of large-scale protests is also overshadowing the race to the White House, according to data from Verisk’s global risk unit.

Verisk Maplecroft’s Strikes Riots and Civil Commotion (SRCC) predictive model shows that the election is taking place at a time of heightened risk.

The model forecasts the likelihood of damaging civil unrest taking place in 198 countries over the next 12 months.

The US presidential election has already been one of the most volatile in modern history, Verisk noted, with two assassination attempts against Republican nominee Donald Trump, and the withdrawal of President Joe Biden.

Verisk warned conditions are “on a par” with those just before the Black Lives Matter (BLM) protests and riots following the death of George Floyd in US police custody, which cost approximately $3bn in insured losses in 2020.

As a result, the US is now ranked as the fifth highest risk country in the world for the issue, Verisk observed.

Compounding the risk, public opinion polls suggest that political polarisation has continued to rise in the country and is now higher than during the last election.

According to Pew Research, around three-quarters of supporters of Democratic contender Kamala Harris and four-fifths of Trump supporters profoundly disagree with the other side’s core values.

A highly charged political environment in the run-up to, during, and after the election is a significant concern as it creates a higher baseline potential for a major unrest event.

Elections are not necessarily good predictors of civil unrest, Verisk Maplecroft cautioned, with most elections globally not sparking violent civil unrest

This year’s global election super cycle has been a good test case for the correlation between major elections and violent civil unrest.

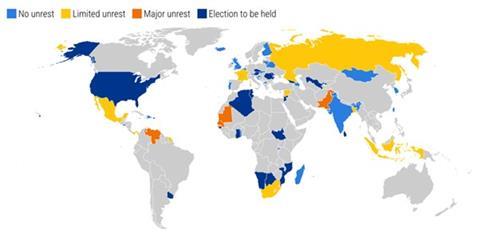

The map below shows that out of the 38 major elections that took place during the first eight months of the year, only four experienced widespread election-related unrest.

The volatile political landscape in the US provides an environment that could spark violent protests and riots in the run-up to and after the election, the report said.

In the event of violence at polling stations or a contested election outcome, the potential for local events to turn nationwide is significant, Verisk Maplecroft warned.

Data from its SRCC predictive model showed a high number of areas face elevated risks. In total, some 755 counties are placed in its “very high or high-risk” categories, based on the severity and frequency of protests, as well as concentration of economic value and people in these areas.

New York tops the list of the 10 highest risk counties for SRCC in US.

1. New York, NY

2. Kings, NY

3. District of Columbia, DC

4. Bronx, NY

5. Queens, NY

6. San Francisco, CA

7. Philadelphia, PA

8. Suffolk, MA

9. Cook, IL

10. Los Angeles, CA

Riots in January 2021 at the Capitol in Washington, DC, underscored the underlying risk of election-related tensions sparking civil unrest, Verisk Maplecroft said.

“Those riots included substantial participation by agitator groups whose presence at demonstrations in the next months could raise the risk of violence,” said Torbjorn Soltvedt, principal analyst at Verisk Maplecroft.

“In parallel, threats against public officials continue to increase, mirroring a global trend of rising polarisation and growing mistrust in public authorities. Not only is the underlying SRCC risk higher than in January 2021, the potential for flashpoints to ignite civil unrest is also greater,” Soltvedt added.

What’s driving US SRCC risk?

The underlying drivers of SRCC risk in the US are complex and varied, according to the company’s SRCC predictive model.

Most importantly the US has a historic propensity for large-scale unrest events, Verisk Maplecroft said.

Climate and development factors, income inequality and a higher risk of extrajudicial or unlawful killings, were particularly relevant in the context of the 2020 riots, also play an important role.

Conversely, the fact that the US economy is performing better than many of its peers is “somewhat tempering” the overall SRCC risk, the report said.

Inflation has come down more quickly than in Europe and the economy continues to grow at a faster rate than others in the G7 or the Eurozone as a whole.

Nevertheless, public sentiment remains as negative towards the economy as it was at the start of the year, suggesting that socioeconomic factors could still spark unrest, the briefing warned.

After the election

Despite a “growing normalisation” of political violence in the US, Verisk Maplecroft warned, specific election-related unrest remains relatively rare, as shown by the “largely peaceful” outcome of the 2022 midterm elections.

However, the “negative trajectory” of the overall SRCC risk environment indicates that election-related events, such as rallies and issue-specific protests, do carry an elevated potential for unrest, the modelling firm warned.

Robert Munks, head of Americas research at Verisk Maplecroft, said: “Crucially, the risk of election-related unrest will rise substantially if the outcome of the election is tightly contested – particularly should Trump lose to Harris.

“In such a scenario, SRCC risks would be likely to rise around ‘political’ targets – including institutional milestones in the presidential confirmation process,” Munks added.

No comments yet