Speaking at an AM Best event in London, Convex’s CEO gave a (re)insurance carrier’s perspective to challenges, from claims activity, operating expenses and market cyclicality, to the balance of power between brokers and carriers.

Paul Brand, CEO and co-founder of (re)insurer Convex, delivered a keynote presentation, titled ‘Beyond the Numbers: A Carrier’s View’, at AM Best’s Europe Insurance Market & Methodology Briefings, held in London on Thursday.

Brand drew a firm distinction between the earnings potential of brokers and carriers in recent years, and that even the strong performance seen at Lloyd’s in 2023 was largely driven by rate movement, rather than new business and “flattish market share”.

“It looks like a very rosy picture”, he said, but adding that “underlying that, there are further questions to ask”.

2024 has seen a lot of natural catastrophe claims activity, he observed, but hard market rates and terms meant that (re)insurers could still likely make a profit.

“Who knows what happens in the balance of November and December, but the [industry] losses so far, will be up to around $150bn already. But the [reinsurance] industry will still likely make money at those sizes of events,” Brand said.

He looked at the medium- to long-term difference in financial performance between carriers and brokers.

A large carrier and a large broker with the same market capitalisation has meant, in recent years, that the broker could earn more than double what an equivalent carrier could expect, he suggested.

“Shareholders are prepared to pay a lot more money for distribution than they are for carriers. That’s changed over the last 15 to 20 years, as brokers have consolidated, and taken more power in the marketplace,” Brand said.

The volume of insured catastrophic losses in recent years suggested carriers had been “doing a good job” at paying insured loss claims, but that “clients are not happy”, despite this.

“We see a huge amount of dissatisfaction from our clients, not unreasonably, because of pricing increases, restrictions in coverage, territories layered out, and the early sort of noises of regulatory action,” Brand said.

“Then you look at share prices for the industry, particularly some recent IPOs, or struggles in getting IPOs off the ground, clearly the shareholder side of the industry is also not particularly happy with the carriers,” he continued.

In 2019, Stephen Catlin and Brand co-founded Convex with $1.7bn of initial committed capital. Brand said that Convex had sought to be “a notable exception” to this trend.

“But the general view of the clients and shareholders, two important constituencies, stakeholders for our businesses, is that something’s going quite wrong,” Brand added.

At the Monte Carlo rendezvous of reinsurers this year, there had been “an attempt by people to say it’s gone too far, the industry has charged too much, and challenged its relevance”, Brand suggested.

“[There was] an assertion that what carriers need to do is march prices back down the hill again and probably let profits follow that. That’s the expectation of both our shareholders, and sadly is also in our distribution’s mind,” he said.

On the side of carriers, he suggested, has been the scale of recent catastrophe events, as well as other significant loss events, like the Key Bridge collapse in Baltimore, the war in Ukraine, or the long-term trend of US liability losses.

While he said he “wasn’t in the predicting game”, perceptions pointed towards more uncertainty and potential for heightened activity.

“And I think that that feature is going to keep the market harder than it would be otherwise,” Brand said.

Carriers need to focus on operational expenses, he warned, not hope that hard pricing “displacement activity” could offset inefficiency.

“Carriers’ job is to concentrate on their own ‘op ex’, and particularly think about how you can use technology and sourcing options to drive better outcomes,” said Brand.

“A mantra that Convex has had since we got started, is that unless it requires judgment, you should be looking to either automate it or outsource it. And if you can’t do either of those two things, then you should forget it,” he said.

Brand asked what needs to happen to alter the balance of power between brokers and carriers.

“Carriers have to make themselves more valuable to clients, and demonstrate their value to clients,” he said.

This was about relationships, and understanding the client, and so that they understand what the carrier can bring, getting “beyond cyclical pricing”, he suggested.

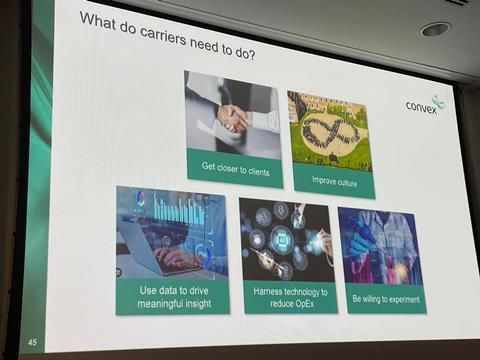

The slide shown in this article summarised the five things he thought carriers needed to demonstrate: getting closer to clients; improving culture; generating data driven insights; harnessing technology to reduce operating costs; and “being willing to experiment” in new products and innovation terms.

“Convex is fundamentally a judgment company. We make decisions; we build portfolios; we buy reinsurance; we build relationships with clients; and that’s how we create value,” he added.

No comments yet