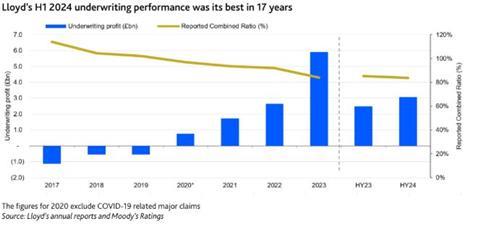

Underwriting performance in the first half of 2024 at Lloyd’s was the market’s strongest in 17 years, the rating agency said, but casualty reserves are a potential weak spot.

Moody’s Ratings has published an “issuer in depth” report on Lloyd’s, saying it expects Lloyd’s to maintain strong earnings and capital over the next 12-18 months.

The Lloyd’s market will be helped by good underwriting discipline, favourable market conditions and robust investment returns, the rating agency emphasised.

However, its profitability “could fall short” of the strong results achieved in 2023 and the first half of 2024 because of higher catastrophe losses and continued reserve strengthening against casualty claims, which have been rising in recent years.

Profitability is “strong and sustainable” at Lloyd’s, Moody’s pronounced.

“We expect Lloyd’s to report robust earnings into 2025 as favorable trends that buoyed the market’s performance in the first half (H1) of 2024 persist,” the rating agency said.

Lloyd’s underwriting profit reached a 17 year high in the first half of 2024 (see chart below).

Profitability was helped by price increases and lower catastrophe exposure as the market stepped up oversight of its 78 insurance syndicates, “and should remain strong for another 12-18 months”, Moody’s said.

“Lloyd’s also benefited in H1 from better investment returns thanks to higher interest rates, with investment income accounting for £2.1bn of total profit for the period, up from £1.8bn a year earlier,” the rating agency added.

Portfolio pruning and price rises can “somewhat mitigate climate risk”, Moody’s suggested.

“Lloyd’s efforts to appropriately reflect risk in pricing and reduce its exposure to major claims have improved the market’s capacity to absorb large natural catastrophe losses, although extreme weather remains a source of potential earnings volatility,” Moody’s said.

“The market’s diversified portfolio, spanning both insurance and reinsurance, is a further moderating factor,” the ratings firm added.

Casualty reserves are “a potential weak spot” for Lloyd’s, Moody’s warned.

In the first half of 2024, Lloyd’s underwriting profit benefited from aggregate reserve releases across all business lines except aviation and energy, the paper noted.

“We expect lower inflation to support overall reserve adequacy in the months ahead, and see Lloyd’s reserve margins as robust enough to absorb most potential claims increases,” Moody’s said.

“However, further strengthening of casualty reserves may be required because of recent rapid growth in casualty claims, fueled by increased litigation and higher jury awards in the US.”

Strong capital buffers can absorb catastrophe losses, the paper emphasised.

Capitalisation at Lloyd’s has reached an all-time high, with market wide and central solvency ratios increasing to 206% and 520% respectively in the first half of 2024, noted Moody’s.

“In recent years, the market has strengthened its capital through additional contributions from members and reduced reliance on letters of credit. We expect its capital to remain robust, capable of absorbing above normal catastrophe losses,” the report added.

No comments yet