Improved underwriting results have driven strong earnings and improved resilience at the four biggest continental European reinsurers, according to rating agency Moody’s.

The four largest European reinsurers reported combined earnings of €10.2bn for their 2023 financial year, more than double the previous year’s total, helped by higher prices and better investment returns, according to Moody’s Investors’ Service.

The rating agency noted similar trends for Munich Re, Swiss Re, Hannover Re and SCOR, as the environment remains supportive and should allow the peer group to further strengthen operating performance in 2024, assuming no major catastrophes spoil the party.

Stronger underwriting results support building of reserve resilience, Moody’s emphasised, with all four reinsurers reporting profitable combined ratios.

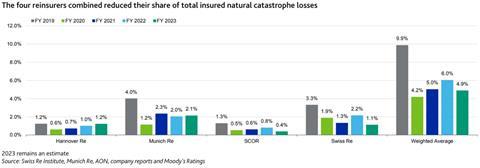

“While global insured claims from natural catastrophes were close to recent highs also in 2023, the reinsurers absorbed a smaller share of them thanks to higher attachment points,” said Moody’s.

“The group of reinsurers also benefited from recent substantial price increases. All four companies took advantage of their strong underlying performance to bolster their claims reserves, adding resilience.”

P&C reinsurance prices have probably peaked, according to the rating agency.

“The peer group reported weaker growth in the price of property & casualty (P&C) reinsurance at the 1 January 2024 policy renewals than a year earlier, when prices rose by their widest margin in many years,” Moody’s said.

“The group was able to maintain favourable terms and conditions and remained selective in terms of underwriting exposures, resulting in relatively modest premium growth.”

Diversification is paying off, Moody’s suggested. The four large European reinsurers all achieved a strong performance at their P&C reinsurance divisions and also reported an improvement at their life operations.

“Specialty and commercial lines continued to deliver solid profits, while Munich Re received additional earnings uplift from its primary insurance business. Stronger investment yields thanks to higher interest rates and benign financial market conditions provided additional tail winds,” said Moody’s.

Capital adequacy is strong, risk profiles largely unchanged. The peer group’s regulatory solvency ratios benefited from strong capital generation, partly offset by dividends and, for some, share buybacks.

“Risk profiles are largely unchanged, reflecting the group’s stable appetite for underwriting and investment risk. Most of the group have committed to progressive dividend policies, restricting their flexibility to reduce shareholder payouts,” Moody’s added.

Lower nat cat claims

Global insured catastrophe losses for 2023 were moderately below prior year levels, according to Moody’s (see first chart below), but remained above long-term averages, partly because of inflationary increases in repair and replacement costs.

“During 2023, the Atlantic hurricane season was relatively benign, but insured losses in the US remained high, driven by a series of severe convective storms. However, the four reinsurers’ combined share of global losses declined,” the rating agency said.

Catastrophe claims were borne mainly by primary insurers, Moody’s emphasised, reflecting reinsurers’ successful efforts to reduce their exposure to higher frequency events such as wildfires.

“While Swiss Re and SCOR’s share of total catastrophe losses fell, driving the overall decrease for the group, those of Hannover Re and Munich Re increased,” Moody’s said.

“Hannover Re cited a large number of catastrophe losses that were individually too small to trigger its retrocession programme,” the report continued.

“Munich Re also reported an increase in the number of catastrophe claims, with the Turkish earthquake of February 2023 alone adding about €0.7 billion of the company’s total €2.3 billion natural catastrophe claims bill,” Moody’s added.

Building reserve resilience

Overall, reserving levels remained favourable, according to Moody’s, with the negative impact of economic inflation - an increase in claims due to higher repair and replacement cost - still significant but declining.

The impact of social inflation – higher claims because of litigation and increased jury awards – on US casualty business remained the main area of concern. Companies have responded by using reserve redundancies in property lines to further strengthen reserves in US casualty lines.

“Building reserve resilience was a common theme among the group of reinsurers. The IFRS reporters benefited from higher discounting than expected and used some of the resulting headroom to strengthen reserves. Hannover Re also made use of a positive one off tax item for this purpose,” Moody’s said.

Munich Re and Hannover Re maintained long established approaches to reserving. However, SCOR said it intends to reserve at the higher end of best estimates and has set an explicit numerical target for reserve resilience, a material change, the report noted.

“Swiss Re also intends to move higher up in the best estimate range under IFRS 17 and aims to build an additional buffer, also a significant change. Bolstering reserves should provide companies with a buffer for when the pricing cycle turns and help in reducing volatility in earnings,” Moody’s said.

“We believe underlying P&C reinsurance earnings levels are currently strong enough to allow companies to build up additional buffers. However, it remains to be seen whether the exceptionally strong price environment will last long enough to allow those that started this process later to do so. In addition, the last two years have shown that more negative than expected claims trends can quickly erode what was initially seen as a reserve redundancy,” the report added.

P&C reinsurance prices have probably peaked

Volume growth weakened at the January 2024 renewals (see second chart below), which Moody’s said it viewed as a sign of underwriting discipline that will help the group preserve margins.

Reduced exposure to US casualty business was one of the main drivers of this. Proportional business contributed positively, as original premiums increased to offset claims inflation and higher claims frequencies, according to the ratings firm.

“Supply and demand were relatively balanced at the January 2024 reinsurance policy renewals. The group of reinsurers reported relatively modest price increases compared with the January 2023 renewals. Nominal price increases were also partly eaten away by higher claims cost assumptions on newly written business,” Moody’s said.

“The group’s commentary on US casualty lines was mixed. Hannover Re cited an increase in risk adjusted pricing and stable business volumes, whereas the other three said they had reduced exposure because prices were inadequate in view of continuously high social inflation.

Pricing in natural catastrophe exposed lines of business remained attractive, but price growth moderated compared with a year earlier,” the report continued.

“Reinsurers’ appetite for lower layers of reinsurance, which are more likely to absorb claims, remained limited. However, competition at the higher levels somewhat intensified. We understand that the leading European reinsurers’ appetite for catastrophe risk remained

largely unchanged, although most took advantage of more favourable pricing to strengthen their retrocession protection,” Moody’s added.

No comments yet