Against the backdrop of the most dramatic re/insurance market we have seen, Gallagher Re’s CEO Tom Wakefield predicts a return to a true market of differentiation for upcoming 1/1 renewals.

The 1 January renewals will see reinsurers differentiate between cedants based on individual risk profiles and exposures, as well as the state of their overall trading relationship, as carriers move away from broad-brush approaches to pricing and T&Cs, according to Gallagher Re’s CEO Tom Wakefield.

Speaking to GR ahead of this year’s Rendez-Vous de Septembre (RVS) in Monte Carlo, Wakefield said, absent force-majeure, he expects 1/1 renewal discussions to be more orderly than the market had witnessed in recent years.

“We’re back to a market where data matters,” he said. “We’re in a market where we can work with clients and really truly differentiate their portfolios.” Wakefield continued.

The chief executive said reinsurers were open to providing both pricing and conditions that are commensurate to specific clients and their needs.

“The overarching message is that we’re back to a market of differentiation, and that’s what we intend to do for our clients,” he said.

Wakefield said the market is now in a place where it will reward clients who offer data and insight as well as positive trending on reserves. This is a far cry from reinsurance renewals over the past 18 months where property cat was considered an unpredictable and volatile class warranting reduced capacity and changes in coverage, attachment, and pricing.

“The 1 January renewals are going to be really varied depending on a number of factors. The type of client, the nature of the exposure, the back year development, the reinsurer relationships – they’ll all be in focus.”

High level dilemma

Wakefield sat down with Global Re on the eve of the 66th RVS and said this year’s Monte Carlo discussions would largely revolve around the need for carriers to maintain profitable earnings without increasing volatility.

Commercial lines (re)insurers are entering an interesting phase where, following substantial enhancements in pricing, terms, and conditions over the past few years, overall performance has also shown improvement. However, the story is slightly different in US casualty, with stakeholders carefully considering appetite for future growth.

As this publication has tracked, the equity outlook has brightened for both insurers and reinsurers. Many reinsurers are currently trading at considerably higher as a multiple of book than they have in recent years.

“The challenge for insurers, more than reinsurers, is that they need to continue to manage volatility, but they’re entering into a different part of the insurance cycle, so growth is going to become harder,” Wakefield explained.

With the insurance cycle expected to soften from a rate perspective, Wakefield suggested that a potential strategy for insurers is to adjust their retentions in an effort to boost net retained earnings. However, this approach carries its own risks. Increasing retentions can lead to greater volatility, a scenario that investors are currently averse to.

Wakefield said top of the agenda for cedants entering renewal discussions at Monte Carlo this year would be how to balance the trade-off between maintaining stability and pursuing growth.

“The high-level dilemma for CEOs of insurance companies is ‘how do I keep volatility down, earnings high, and achieve top line and bottom-line growth in an insurance market which is price adequate but coming off from a rate perspective,” he said.

“I think that will dominate a lot of conversations and what reinsurance products are available to support this,” Wakefield continued.

Property: Supply and demand to grow in tangent

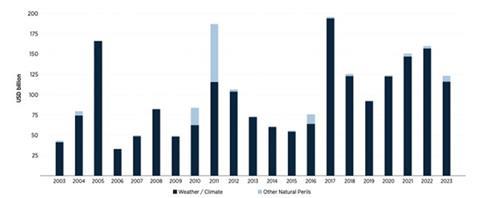

2023 was the fourth year in a row where insured losses exceeded $100bn

Source: Gallagher Re Natural Catastrophe and Climate Report 2023

Drilling down into property cat renewals, Wakefield reiterated that there was a need to provide more earnings protection, with cedants currently taking almost 100 percent of the losses that are coming through.

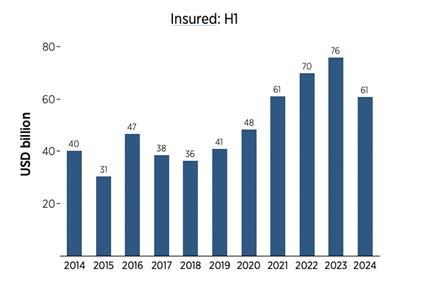

According to Gallagher Re’s Natural Catastrophe and Climate Reports, 2023 was the fourth year in a row of insured losses greater than $100bn (see table 1). In the first half of this year, insured nat cat losses stood at $61bn, 25 percent higher than the decade average of $49bn (table 2).

Wakefield explained that in 2023 that equated to nearly 3 percentage points being added to the combined ratio of US personal lines carriers, but reinsurers globally saw a 1 percent benefit from lower than expected natural catastrophe losses.

“Insurers are taking a disproportionate amount of elevated cat losses and reinsurers are taking less than they have done in the past,” he said.

Discussing how cedants were structuring - or restructuring - property cat programs, Wakefield said that there was an increase in demand at the top end of programs that has been driven by the inflationary environment.

“If we look at our cat book on a constant set of clients, limits are up about 8 percent which implies around $35-40bn of additional limit,” he said.

“That sounds like a big number, but really it’s just carriers catching up with the limit they would have liked to have purchased 12 or 18 months ago, but either they couldn’t because it wasn’t available or because it was price prohibitive,” Wakefield continued.

He said that despite inflation slowing down, the laggard effect of demand would probably push another $20bn into the market in 2025 – or around 4 percent more limit on global cap – with ample capacity in the market to support that growth.

“We think supply will grow and demand will grow together,” he added.

Challenging, but never a truly hard market

Insured losses in H1 2024 stood at $61bn

Source: Gallagher Re Natural Catastrophe and Climate Report First Half 2024

Discussing pricing, Wakefield said he expected the downward pressure on pricing witnessed at the mid-year 2024 renewal seasons to continue at 1/1.

“The reality is that the pricing – particularly at the higher end of cat programs – is more than adequate as far as reinsurer’s models are concerned,” Wakefield said.

And while he acknowledged that reinsurers would continue to look for growth opportunities, it is expected to be disciplined.

Wakefield argued that the market of recent years, while tough, was never truly hard. He characterised it as a challenging market.

“It doesn’t feel like we’ve really been in a hard market. For me, the definition of a hard market is when you can’t place something.”

He said that while you could “probably argue the case” for the market being hard for certain earnings cover, aggregate at the bottom end of programs and aggregate retro, this hasn’t been the case for core occurrence based property placements.

“We’ve never been in a situation where we can’t find the capacity, but it has been a challenge to purchase the right structures at acceptable price and coverage,” he said.

In discussions ahead of 1/1.2025 Wakefield said Gallagher Re was in a position to now provide the “additional asks” for clients, whether that’s being more flexible at the bottom end of programs, or whether that’s buying more limit.

“We expect cedants to be able to purchase programs at 1 January which are more aligned with what they really wanted to buy than what they had to buy,” he continued.

“So, we feel pretty good about the market, an opportunity to develop coverage in a way that lines up alongside our clients exposures,” he concluded.

No comments yet