The technology firm surveyed more than 400 global insurance executives to uncover technology and artificial intelligence (AI) trends, revealing that replacing legacy systems remains a significant challenge.

Earnix has announced its third annual survey on the state of the insurance market, its “An Industry at a Crossroads”, 2024 Industry Trends Report.

More than two-thirds (70%) of respondents expected to deploy AI models that make predictions based on real-time data in the next two years.

The technology firm, which uses AI within its cloud-based platform, surveyed more than 400 global insurance executives.

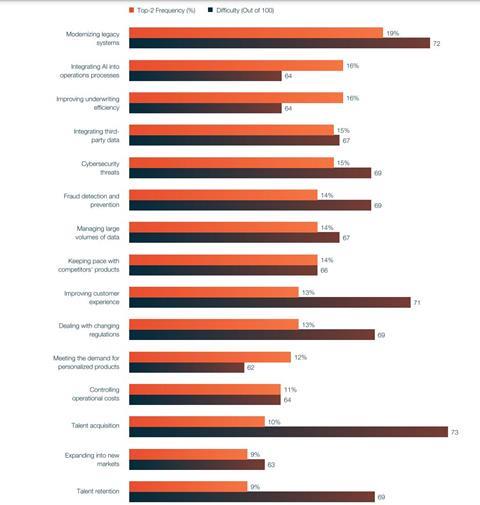

Modernising legacy systems was the top challenge earmarked in the report (see chart below).

More than half of respondents (51%) reported their company had to pay a fine or issue refunds due to errors in the last year

Some 58% of respondents said they would take more than five months to implement a rule change and 21% take longer than seven months.

Insurers still need to move beyond legacy systems and fully modernize their operations, yet 49% admitted they are behind schedule.

“After decades of slowly adopting innovative new technologies, the insurance industry is now ready, willing, and able to take the leap toward a more technologically advanced future,” the report’s executive summary said.

“It’s more than just a commitment to replace outdated legacy systems; for example, our research shows that more than two-thirds of insurers expect to deploy new AI models and capabilities in the next two years.

“Such priorities are commendable but may not be possible as quickly as some insurers might hope,” the paper added.

Click here for an interview with Earnix’s CEO, and here for another with its strategy director – both focused on the future of AI and the insurance sector.

No comments yet