An active natural catastrophe period combined with the Russia-Ukraine conflict are driving claims severity

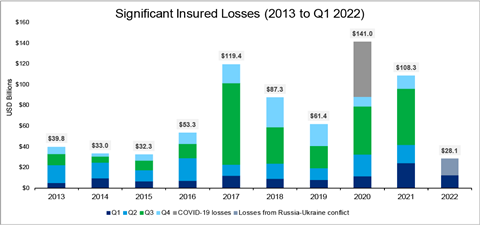

An active natural catastrophe period combined with the Russia-Ukraine conflict may result in $28-30 billion in global insured loss in the first quarter of 2022. This estimate is preliminary.

The most destructive natural catastrophe event was a series of European windstorms (including Storm Dudley and Eunice), with insurers exposed to losses of over $4.2 billion.

Other notable events included floods in Australia that caused losses of $1.8 billion and the earthquake in Japan, which is estimated to cause approximately $3 billion in insured losses.

Specialty insurance losses from the Russia-Ukraine conflict are currently estimated at around $16 billion.

This is a preliminary estimate, which includes insured aviation losses from airplanes currently in Russia ($6 billion) and other specialty-lines insurance losses, including political risk, trade credit, marine hull war, and cyber risk ($10 billion).

No comments yet