All News articles – Page 32

-

News

NewsRonda appointed Howden Tiger CEO

Ronda joined TigerRisk Partners in October 2021 from Aon where he was latterly global geographic leader of Reinsurance Solutions.

-

News

NewsArch Insurance appoints new MD in Bermuda

Matthew Smith is an internal appointment to managing director for the insurer, after the retirement of Tony Hay.

-

News

NewsAon names Nichols as Bermuda client leader

Jake Nichols joins from Aeolus Capital Management to be Aon’s global reinsurance clients leader in Bermuda.

-

News

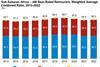

NewsAM Best publishes reports on MENA and Sub-Saharan African reinsurers

The rating agency reports that reinsurers across MENA and Sub-Saharan Africa report topline growth, despite persistent or heightened economic challenges.

-

News

NewsFraccalvieri named as EMEA fac leader for Aon Reinsurance Solutions

Nicola Fraccalvierii re-joins from rival reinsurance broker Guy Carpenter, where he led fac across continental European plus London for casualty, specialty and financial lines.

-

News

NewsCharting Lockton Re’s journey into full spectrum broker

Keith Harrison, Lockton Re’s international CEO, joined the reinsurance broker from rival JLT Re in 2019. Fast-forward a few years and Lockton Re has organically grown into a different animal.

-

News

NewsEmpowering Insurance Agility: Technology’s Crucial Role in Advanced Exposure Management

In the intricate tapestry of re/insurance, where uncertainty and opportunity entwine, effective exposure management emerges as the compass guiding insurers through a dynamic, ever-evolving market, writes Ebix Europe sales director James Pring.

-

News

NewsWar risk and cyber restrictions weigh on cargo renewals – IUMI panel

Cargo reinsurance underwriters are adding fresh restrictions, particularly relating to cyber and war risks, but what’s covered and what’s not under new wordings is a cause of confusion for brokers and clients, according to a reinsurance panel at IUMI 2023.

-

News

NewsAon’s Schultz on a record year for cat bonds, cyber ILS outlook, and ‘Bermuda-esque’ London Bridge 2

Bouncing back from a tough end to last year, 2023 will be a record year for the catastrophe bond market, according to Aon Securities CEO, Paul Schultz.

-

News

NewsTalanx launches rights issue in search of €300m capital

The German insurer said the goal of its capital raising exercise was to enhance the trading liquidity of its shares and strengthening its position in equity indices.

-

News

NewsGreen shoots have now taken root – S&P Global Ratings

‘We believe that the sector is now well equipped to earn its cost of capital,’ says director of insurance ratings.

-

News

News‘Flight to quality’ provides confident outlook for 2024 – Hannover Re

‘Adequate pricing is a prerequisite for us to offer the best possible reinsurance capacity,’ says the reinsurer’s chief executive.

-

News

NewsNo clear price or definition for SRCC risks, warns MAPFRE RE

The Spanish reinsurer did not succeed in getting SRCC exclusions and restrictions it sought during July’s Latin American renewals, and wants to tighten terms for social unrest risks in 2024, MAPFRE RE’s CUO told GR at the Monte Carlo RVS.

-

News

NewsChedid Capital acquires Trilogy London market MGA

The MGA arm of Chedid has announced the acquisition of UK-based Trilogy Managing General Agents.

-

News

NewsUnderwriting discipline crucial – Munich Re

$100bn of annual insured losses in natural catastrophe is the new normal, says Munich Re board member.

-

News

NewsMoving on up - GR’s annual RVS benchmarking survey

Hard market momentum continues as hurricane season gears up. Pricing is expected to rise, said the overwhelming majority of respondents to GR’s 2023 renewals survey.

-

News

NewsICEYE: A new level of situational awareness

Global Reinsurance spoke to ICEYE’s Andy Read about the critical role of hazard data in supporting public-private partnerships and how the satellite-data company is working with governments to improve disaster response.

-

News

NewsPreparation key ahead of specialty lines renewals – Guy Carpenter analysis

Stability returned to the market at mid-year renewals for specialty reinsurers buyers, but firming rate pressures continue, terms are tight, and capacity at lower attachment points is limited.

-

News

NewsLondon could be a $10bn ILS market in five years

Michael Wade, former crown representative for insurance, who pioneered London market ILS legislation, shares his hopes and expectations for the growth of capital markets risk transfer in London.

-

News

NewsLockton Re makes bid to separate first and third party cyber risks

The broker used a Monte Carlo briefing and cyber risk report to note a divergence of appetites between reinsurers comfortable with first party short tail risks and third party long tail risks.