All News articles – Page 9

-

News

NewsPool Re appoints Stark as head of underwriting

Andrew Stark starts a newly created role at the UK’s terrorism reinsurance public-private partnership.

-

News

News‘Polycrisis’ presents insurers with ‘impactful’ opportunity – Axa UK & Ireland CEO

Plus, Aviva’s UKGI boss emphasises that insurers must ‘put our money where our mouths are’ when it comes to engaging on ‘collective goals’.

-

News

NewsTwo-thirds of insurers plan to implement AI predictive models within two years – Earnix

The technology firm surveyed more than 400 global insurance executives to uncover technology and artificial intelligence (AI) trends, revealing that replacing legacy systems remains a significant challenge.

-

News

News‘Inflection point’ reached in US casualty reserving – Lockton Re

Reinsurance broker’s paper highlights potential end to material adverse development in casualty lines for calendar year 2025.

-

News

NewsAon Underwriting Managers hires new CUO

Simon Clapham, formerly of Brit and Liberty Specialty Markets, joins Aon’s MGA operation as its chief underwriter.

-

News

NewsExtinction Rebellion targets multiple London market insurance firms

The climate change protest group has carried out a campaign of protests targeting insurance companies across London.

-

News

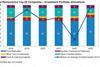

NewsReinsurer ROEs rise on underwriting, investment results – AM Best

AM Best’s DuPont analysis indicated reserve leverage for the composite dropped, led by non-life reinsurers, other than the ‘big four’, whose reserve leverage was relatively stable.

-

News

NewsRiverStone and QBE announce loss portfolio transfer deal

Run-off re/insurer takes on reserves of $1.2bn for Lloyd’s syndicate legacy business from QBE.

-

News

NewsSaudi Vision 2030 & GHE 2024: where the tech revolution and health re/insurance meet

Editor of GR, David Benyon, reflects on health technology trends for re/insuring the sector, from a recent trip to Saudi Arabia, attending GHE 2024.

-

News

NewsNat cats in 2024 likely to surpass last year’s claims bill – Aon

A Q3 Global Catastrophe Recap report from Aon Reinsurance Solutions sees nat cat losses already exceeding $102bn for this year, while global reinsurer capital neared $700bn as of the year’s halfway point.

-

News

News‘Do the simple stuff first’ with data journeys – AdvantageGo’s Summers

Long projects in technology have very bad track records,’ warns AdvantageGo’s global business leader Ian Summers.

-

News

NewsFrom Mariupol to Gaza – measuring political violence losses with Charles Taylor Adjusting

Loss adjustment from warzones is a service in high demand, given the geopolitical state of the world in 2024, and the rising prominence of war, political violence and terrorism business among London market re/insurers.

-

News

NewsAI and insurance: ‘The Hare and the Tortoise’ – Earnix CEO interview

The insurance industry is renowned for its conservatism; AI on the other hand, is talked of in revolutionary terms; where and how will the two meet?

-

News

NewsBetter risk selection could cut 16% from cyber insurers’ loss ratios – Gallagher Re

After a global study of 62,000 organisations, the reinsurance broker suggests removing “most at risk entities” from cyber insurance books could reduce loss ratios by up to 16%.

-

News

NewsIndustry relevance focus at Baden-Baden for Guy Carpenter, Swiss Re

Reinsurance broker Guy Carpenter emphasised “clearly defined roles”, partnership and innovation for its Baden-Baden Reinsurance Symposium.

-

News

NewsIUMI’s marine insurance stats reveal premiums rise

A 2024 analysis of the global marine insurance market was released by the International Union of Marine Insurance.

-

News

NewsBaden Baden: Hannover Re expects German floods to lead to price gains

Severe weather means the German reinsurer anticipates further price increases and improved terms at January renewals.

-

News

NewsEXPANDING HORIZONS: RVS Global Executive Breakfast Roundtable 2024

As its role as a leading reinsurance market hub continues to evolve, what’s next for the DIFC? And what can the experiences of other reinsurance hubs around the globe teach us? Our breakfast discussion at Monte Carlo’s Rendez-Vous de Septembre 2024 sought to find out.

-

News

NewsAI adoption in the insurance sector: views may differ – Earnix

Many people are still getting their heads around what artificial intelligence means. Perceptions of it vary considerably, for a technology based on data and certainty, with plenty of uncertainty about how its insurance industry rollout should proceed, Aaron Wright, director of Strategy, Earnix, tells GR.

-

News

NewsMilton to cost $26bn “best estimate” insured loss – Moody’s RMS

Hurricane Milton will cost insurers and reinsurers somewhere in the range of $22-$36bn, according to Moody’s RMS Event Response.