Rokstone appoints Hussey to lead DIFC office

Giles Hussey joins the international specialty re/insurance MGA in Dubai from his previous role at reinsurance broker Guy Carpenter.

Davies opens Qatar office to grow Middle East footprint

Ricky Maloney, who serves as Qatar country executive and head of the GCC region, will lead the office.

El Bahtouri and Bouanani join Specialty MGA in Casablanca

Laila El Bahtouri and Mohamed Bader Bouanani join the Middle East and African focused MGA from Moroccan reinsurer SCR.

Bouabane named Salama group CEO

Dubai insurer Salama’s new chief executive was previously CEO of AIG’s GCC and North Africa operations.

DWIC speaker preview: Crisis management lessons with WTW’s Thomson-Hall

At next month’s Dubai World Insurance Congress (DWIC) 2025 event in Dubai, speaker Pamela Thomson-Hall, CEO, international, WTW, will share insights on managing geopolitical risk crises.

MENA re/insurers’ ratings trending ‘positive’ despite regional challenges – AM Best

Despite country risk and the Middle East and North Africa region’s challenging regional geopolitical conditions, the rating agency says re/insurers’ creditworthiness is net positive.

Digital Transformation: A Middle Eastern Opportunity – Verisk

Verisk’s Tim Rayner spoke to GR on challenges of navigating technological changes in a complex marketplace, and opportunities in the UAE and Saudi Arabia.

Munich Re appoints Hanh P&C treaty head for India & SE Asia

Hanh Nguyen will succeed Joachim Zagrosek from 1 March after serving as deputy.

Hiscox, Howden, Swiss Re and Insurance Development Forum launch $9.25m Syrian drought partnership

Re/insurance firms working together on climate risk insurance project to protect vulnerable communities from the impacts of drought in Syria.

Insurance House Appoints Abu Quora as new CEO

Abu Dhabi-based subsidiary of Finance House Group has appointed of Mohammad Alamin Abu Quora as its new chief executive with the aim “to drive strategic growth”.

MS Amlin expands DIFC presence with MENA credit and political risk launch

Lloyd’s speciality insurer expands Dubai operations with hire of Osama Elshiekh from The Hartford.

ASR launches first Africa focused Lloyd’s consortium

Baobab will work across political risk, trade credit, political violence & terrorism, property, energy, construction and liability lines.

ASR Middle East starts operating via Lloyd’s Dubai

Africa Specialty Risks Syndicate 2454 is operating through its service company in the Dubai International Financial Centre.

Saudi Re highlights impact of local market reinsurance premium cession

The Saudi regulator’s regime for local market reinsurance premium cession takes effect from 1 January 2025, affecting at least 30% of all reinsurance treaties and facultative risks, Saudi Re noted in remarks published on the country’s stock exchange website.

Saudi Vision 2030 & GHE 2024: where the tech revolution and health re/insurance meet

Editor of GR, David Benyon, reflects on health technology trends for re/insuring the sector, from a recent trip to Saudi Arabia, attending GHE 2024.

EXPANDING HORIZONS: RVS Global Executive Breakfast Roundtable 2024

As its role as a leading reinsurance market hub continues to evolve, what’s next for the DIFC? And what can the experiences of other reinsurance hubs around the globe teach us? Our breakfast discussion at Monte Carlo’s Rendez-Vous de Septembre 2024 sought to find out.

Saudi Re appoints Ahmed Al-Jabr as new CEO

The reinsurer’s new CEO was previously leading Saudi Re in an acting capacity; in the first half of 2024 Saudi Re grew its book by 19% to SAR 1.4bn gross premium.

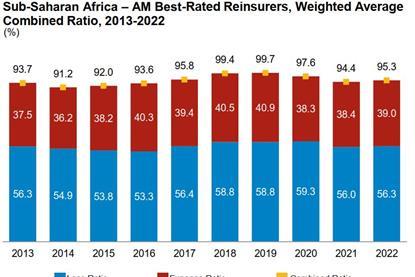

Positive pricing dynamics benefit MENA and SSA reinsurers – AM Best

Two reports from rating agency AM Best give an upbeat summary of the market environment for reinsurers in the regions of Middle East and North Africa (MENA), and Sub-Saharan Africa (SSA).

DWIC Roundtable: The explosion of PV

Demand for political violence (PV) protection has risen across MENA markets, driven by geopolitical volatility, as well as growing client awareness about this nascent product. A roundtable on day two took a deep dive into an evolving market.

DWIC Roundtable: MGAs as catalysts for change

DWIC’s day one roundtable discussed how MGAs are reshaping the traditional distribution model and driving efficiency in underwriting and product development.

Chedid Capital appoints ex Sompo Canopius CEO Davies as non-exec to Milestone board

The Middle Eastern re/insurance broker said it was ramping up its global governance efforts with the appointment of Stuart Davies, who previously served as group CEO of Sompo Canopius.

GIG appoints new board led by Fairfax’s Khosrowshahi as chairman

Fairfax Financial is majority shareholder of Kuwait-based Middle East insurer Gulf Insurance Group.

Chedid Re adds Vandendael as non-exec to board

The Middle Eastern reinsurance broker has appointed the former chief commercial officer of Lloyd’s as an independent non-executive director of Chedid Re Global Operations’ board.

DWIC 2024 post event report: From Uncertainty to Opportunity

An event report on this year’s record-breaking Dubai World Insurance Congress, in association with the Dubai International Financial Centre Authority.

‘Lessons to be learned’ from Dubai April rainfall – IGI’s Labat

The heavy rain that hit Dubai in April 2024 were a major talking point in one-to-one meetings at this year’s DWIC.

What next after Dubai’s 'unprecedented' heavy rains? - Chedid Re interview

On 16 April, Dubai was affected by sudden, heavy rains that caused significant damages. Elsewhere, in Al-Ain, just over sixty miles from Dubai, nearly three times the usual annual rainfall was experienced in a single day.

Fidelis Partnership to open Abu Dhabi office

Matthew Warren joins from broker Oneglobal to lead the office as executive chairman of Fidelis MEASA.

AM Best keeps ‘stable’ outlook on Gulf insurance markets

The insurance markets of the Gulf countries are broadly stable, the rating agency said in a segment report, but reinsurance was flagged as a vulnerability for local carriers.

DWIC 2024: Insurers need to focus on risk management and mitigation - Lloyd's' Mackinnon

The world is in a “manageable plateau of chaos”, says Chris Mackinnon, deputy regional director, Asia Pacific, Middle East & Africa, Lloyd’s, but insurers and reinsurers must adapt to help businesses survive.

DWIC 2024: Insurers should be more consistent – QBE’s Horton

Insurance is more important than ever to help businesses manage escalating risks, Andrew Horton, group CEO of QBE, told DWIC 2024. However, to do this successfully, he argued that insurance companies should prioritise one of its key strengths: consistency.

DWIC 2024: ‘Climate crisis on everyone’s agenda’ – Lloyd’s deputy chair Vicky Carter

As temperatures across the globe continue to rise, the re/insurance industry must play a vital role in helping the green transition, says Vicky Carter, deputy chair of Lloyd’s and chairman, global capital solutions, international, Guy Carpenter.

DWIC 2024: A record-breaking year for the DIFC

The Dubai International Financial Centre (DIFC) saw gross written premiums reach almost $2.6bn, says Alya Al Zarouni, chief operating officer at the DIFC Authority, opening keynote for DWIC 2024, which got underway in Dubai today.

Hannover ReTakaful: ‘We are fully committed to the MENA region’

Olaf Brock, managing director and CEO of Hannover Re’s Bahrain branch and Hannover ReTakaful, provided GR with a pre-DWIC Q&A.

The new PV reinsurance market hub in Dubai

There are at least ten active carriers or MGAs of political violence re/insurance operating from the Dubai International Financial Centre, one senior Dubai-based underwriter says.

Dubai floods add to claims, reinsurance costs for local insurers – Moody’s

April storms mean claims and increased reinsurance costs for GCC insurers, according to a rating agency report.

Chedid Capital buys remaining 20% stake in Groupe Ascoma

The Middle Eastern re/insurance broker moves to further cement its position in Africa’s insurance market.

Gabriel using AI to prevent and respond to mass shootings

Artificial intelligence (AI) can be used for many things, but is responding to and preventing mass shootings its next frontier?

Howden launches Red Sea cargo war risk facility

First of its kind insurance facility within an active conflict zone to protect ships and strengthen global supply chains.

Canopius appoints CEO for APAC and MENA

Specialty re/insurer Canopius has announced the appointment of Soon Keen Lee as CEO of Asia-Pacific and Middle East & North Africa, subject to regulatory approval.

Saudi the ‘main driver’ for Dubai business – IGI’s Labat

IGI’s Dubai hub prioritises facultative business, because treaty reinsurance competition is fierce in the Middle East and sees a construction boom in Saudi Arabia as its biggest pipeline for growth.

Middle East retention levels rising – Chedid Re’s Abi Rached

Local insurers have “more skin in the game” due to the hard market for reinsurance.

Oman Re gains Retakaful licence

Oman’s Capital Market Authority grants a licence for Oman Re to underwrite Retakaful, providing Islamic compliant reinsurance solutions for Takaful business.

Trust Re seeks return to rating as rebuild continues – Albaharna GAIF34 interview

Chief executive of Trust Re explains the reinsurer plans to restore it’s former rated A-rated status, putting an end to temporary fronting arrangements while its shareholding issue is resolved.

BLOG: GAIF OMAN 2024

Daily news updates from GAIF OMAN 2024

Driving behaviours to increase climate risk resilience – SCOR at GAIF34

Reinsurance rates are being driven by increased claims and exposures, but the insurance industry has the data in its power to incentivise construction practices that will in turn reduce insureds’ exposure to climate change, and the prices paid for protection.

Temperatures are rising and MENA’s protection gap leads the world – Swiss Re at GAIF34

2023 saw major earthquakes in Turkey and Morocco, severe thunderstorms and flooding in Saudi Arabia and the UAE, hailstorms in Jordan, a tropical cyclone in Oman, and a major flood in Libya.

Construction boom to lead expected growth for Gallagher’s Dubai practice

Onshore and offshore construction, M&A and financial lines are the top priorities for the reinsurance broker’s Middle East hub, Nadim Semaan told GR at GAIF34.

Abouzaid welcomes delegates to GAIF34 in Muscat

Secretary general of the General Arab Insurance Federation, kicked off the GAIF34 conference, which is back in Oman for the first time since 2002.

Getting ready for GAIF in Oman and developing regional insurance talent

This year, the GAIF conference returns to Oman for the first time in more than two decades. Two of the country’s leading insurance figures sat down to talk with Global Reinsurance before the event begins in Muscat.

Interview with GAIF’s Chakib Abouzaid: Is the Gulf region an awakening insurance giant?

It’s one thing to lead an insurance federation during a period of small, incremental change. But the role is different when the regional industry is undergoing a broad and deepening transformation.

Rising political risk for emerging market manufacturing hubs - Verisk Maplecroft

Heightened political risks are overshadowing a ‘friendshoring’ shift, according to report data from Verisk Maplecroft.

Optio expands MENA operation with senior Dubai appointment

New hire joins from Ardonagh Specialty as managing director of broking and general lines for Optio Re MENA in Dubai.

MS Amlin launches financial lines for Middle East

Lloyd’s market re/insurer announces new business class for MENA region amid growth in M&A and IPO activity.

Gulf Insurance Group says “business as usual” after shareholder change

Fairfax completes acquisition of KIPCO’s stake in the Middle East and North African insurer, giving it 90% ownership of the Kuwait City-based insurer.

Expanding DIFC promoted as MGA hub for Middle East, Africa and South Asia access

MGAs represent 43% of DIFC’s insurance constituents, as of September, contributing $2.1bn of gross written premium.

Chedid Re named reinsurance broker of the year by MEIR

Chedid Re was recognised as “Reinsurance Broker of the Year” at the Middle East Insurance Industry Awards 2023 held on November 16.

DIFC on track for 20% re/insurance client growth

Gross written premiums in the first half of 2023 increased up 18% on the year before, reaching $1.2bn, with DIFC’s re/insurance client growth led by new MGA licences.

AM Best publishes reports on MENA and Sub-Saharan African reinsurers

The rating agency reports that reinsurers across MENA and Sub-Saharan Africa report topline growth, despite persistent or heightened economic challenges.

DWIC 2023: Caught out by the hard market

A DWIC roundtable on underwriting discussed the impact of hardening reinsurance rates and new technology

DWIC 2023: Health insurance space fit and well

COVID-driven awareness, population shifts and technological enhancements keeping health insurance market optimistic

DWIC 2023: Spotlight on skills and talent

On the back of the DIFC’s Talent Week, a panel of experts discussed the skills gap and how to close it

DWIC 2023: Takaful must rebrand itself as the ethical choice for all

Collaboration between takaful providers is essential if the niche industry is to achieve its potential

DWIC 2023: Insurers are 'on the frontline' in the climate crisis

The insurance industry must “drive the pathway to net zero”, explained Dame Susan Rice in a fireside chat

DWIC 2023: ‘Force’ needed to spark industry climate action

As the consequences of climate change endure, further industry regulations will be required to halt its effects

DIFC’s Alya Al Zarouni opens Dubai World Insurance Congress 2023

This year’s Congress is the largest event of its kind in the region, welcoming over 1,100 insurance leaders to the UAE

‘Be part of climate conversation,’ DWIC 2023 delegates urged

With COP28 heading to the city in November, this year’s DWIC opened with a rallying cry for the industry to focus on the climate

DWIC 2023: Plenty of cause for industry optimism

Despite choppy environmental, economic and geopolitical conditions, there are green shoots of opportunities for the industry

DWIC 2023: Time for emerging markets to shine

A dearth of cheap and plentiful reinsurance capacity could force emerging insurance markets to mature more rapidly

GCC markets retain stable outlook amid challenging headwinds

The rising cost of reinsurance, competitive pressures and growing impact of nat cat losses remain a challenge – AM Best

GCC insurers benefit from strong premium growth

S&P expects a modest uptick in earnings if insurers continue to reprice underperforming business

David Robinson appointed CEO of Optio Group

He was instrumental in establishing Optio Re MENA Ltd, which began trading February 2023

Optio Re MENA commences trading

The specialty MGA is now open for business in MENA through its Dubai-based operation

Chedid Capital and IRM launch certificate in risk management

The course is aimed at insurance and reinsurance professionals across MEASA and has been ‘eagerly awaited’

Volante opens shop in the DIFC

It will offer a combination of treaty and facultative reinsurance across multiple lines through Lloyd’s Syndicate 1699

QIC Global adopts Antares name and brand

QIC Global is part of the QIC Group, which is the largest insurance company in the Middle East

Chedid Re names Elie Abi Rached global CEO

Joe Asmar has been named deputy CEO, whilst retaining his role as group head of facultative reinsurance

Gallagher Re & Africa Re partner to tackle Africa’s protection gap

Regional drought conditions and the global political environment call for prompt action around resilience and risk transfer solutions

Aon Saudi Arabia appoints CEO

Samer AlFayez was previously chief executive officer of Elite Insurance and Reinsurance Brokers

Chedid Re receives license to operate in Cairo

Egypt is a “strategic bridge” between Chedid’s African operations and its Middle East presence

DWIC 2022: Why we’re still talking about it

The buzz at the conference in Dubai was palpable from the minute it opened on 9 March

Gulf Business News: DIFC, Global Ethical Finance Initiative join hands to support COP28 agenda

DIFC and GEFI aim to drive change across the world’s financial industry relating to delivering net zero, unlocking Islamic finance, financing nature and biodiversity, and financing sustainable development goals

DWIC2022: ESG: Rising to the challenge - Middle East potential

Insurers and brokers who undercut the environmental, social, and corporate governance standards (ESG) will face ‘catastrophic’ consequences, a roundtable on the topic heard.

DWIC 2022: View from the top

The insurance industry is failing to react quickly enough to the fast-evolving digital world around it.

DWIC 2022: Pandemic accelerates insurtech growth

The insurtech sector in the MENA region has enjoyed substantial growth over the past two years, in part driven by the global pandemic.

DWIC 2022: Why takaful needs an overhaul

Inherent issues with the Takaful model continue to hinder the market’s development in the GCC

Gallagher launches fac business in the DIFC

Gallagher has taken a majority share of 51% of ACE Re Ltd (DIFC); Its team and clients will trade as Gallagher going forward

Kay International AMEA expands its operations to US to serve Latin America & Caribbean region

Kay International AMEA LLC has initiated business activities from its new office in Miami, Florida, after receiving its regulatory approval from the Florida Department of Financial Services to operate as a Reinsurance Underwriting Agency and Reinsurance Intermediary.

Leaders from World Alliance of International Financial Centers convene in Dubai for the first time at DIFC

Arif Amiri, CEO of DIFC Authority, commented: “DIFC is delighted to be hosting the World Alliance of International Financial Centers’ Annual General Meeting. It is the first time leaders from financial centers across the globe have chosen to convene in Dubai.

Willis Re launches flood model for MENA region

Currently, the model covers Morocco, the United Arab Emirates, and the Kingdom of Saudi Arabia, with further releases for Oman, Qatar, and Egypt in the third and fourth quarters of 2021.

UAE: Lloyd’s broker expands office

Tysers, a Lloyd’s broker, is expanding its presence in Dubai to meet the growing demand for insurance expertise in the Middle East.

QIC Group net profit jumps 210% to QR205mn in Q1

Mena region’s leading insurer Qatar Insurance Company (QIC) reported robust results with a net profit of QR205mn for the first quarter of 2021 compared to a loss of QR186mn in Q1, 2020.

QIC Group reports QR12.2bn gross written premiums in 2020

Doha: Qatar Insurance Group’s, the leading insurer in the MENA region, gross written premiums for the year have remained stable at QR12.20bn, compared to QR12.06bn for 2019. The Group yesterday announced its financial results for 2020.

Qatar Insurance Company (QIC) has seen its gross written premiums grow by 4%

The leading insurer in the Middle East North African (MENA) region announced its financial results for the first nine months of this year, following a meeting presided over by Sheikh Khalid bin Mohamed bin Ali al-Thani, QIC chairman and managing director.

AM Best’s Insurance Market Briefing - MENA to Examine Current Trends and Their Future Impact

AM Best’s annual Insurance Market Briefing - MENA will be held as a complimentary webinar on 3 November 2020, at 14:00 hours, Gulf Standard Time (GST), to discuss the (re)insurance markets of the region.

Swiss Re: Re/insurance in the Middle East and Pakistan: annual outlook and review 2020

Coronavirus has transformed the outlook for the economies and insurance industry in the Middle East and Pakistan, with recession expected this year. We expect the economic recovery to start in mid-2021, although downside risks include a resurgence in COVID-19 cases, new government lockdown measures, lower-for-longer oil prices and a low ...

Dubai World Insurance Congress 2022: Building a ‘Hybrid’ event

Join us at the biggest ‘pre-scheduled business meet-up’ in the Middle East.

Best’s Market Segment Report: MENA Reinsurers Strive to Adapt to Testing Conditions

Regional reinsurers operating in the Middle East and North Africa (MENA) are no strangers to challenging operating conditions. In recent years, the region’s reinsurance market has been characterised by competitive pricing pressures, overcapacity and increased incidence of large losses.

DWIC 2020: Post Event Report

Full coverage of the DWIC2020 Satellite Sessions

DWIC interview: Andy Rogers, co-CEO, Amdaris

David Benyon, editor, Global Reinsurance speaks with Andy Rogers, co-CEO of Amdaris and Adrian Sutherland, CTO, Jumar about how technology is transforming (re)insurance.

Innovation in Middle East markets – a little less conversation, a little more action

Insurers in Middle East markets talk about launching new products, but not enough innovation follows, JLT Re’s Russell Walters told GR

Takaful faces market awareness challenge: Even some people who work in it don’t know what it does

The Takaful and Re/Takaful sector has an image problem and general lack of awareness about what it can do, according to speakers at DWIC 2019

Seize opportunities coming to the UAE soon

Panellists on the final MENA session from day one of DWIC 2019 talked about new product opportunities the region could see soon.

Healthcare tourism could be a strained market's saving grace

The health insurance market is struggling to keep up with demand, but a new trend has emerged, says Axa Global Healthcare’s Laurent Pochat-Cottilloux

African markets waiting for a catalyst

Africa shows great growth potential, but it needs a push from insurers willing to take a chance

Insurance wrappers for government bonds - Willis Re's Vickers on market opportunities

Fiscal pressure on governments could be one of re/insurance’s biggest opportunities, Willis Re International chairman James Vickers told DWIC 19 in Dubai

Weak market leaves reinsurers under pressure

“Soft-hard” pricing after recent renewals leaves reinsurers under pressure, DWIC 2019 heard from a roundtable debate on the state of the market

DWIC 2019: Day 2 live and free

Catch up with all the news from the Dubai World Insurance Congress 2019

Reinsurers shifting focus from cat business – Axa XL’s Watson

Disruption to core catastrophe business is leading to a significant change in the global reinsurance market as reinsurers place greater emphasis on margin expansion in other lines of business, David Watson, chief executive international reinsurance at Axa XL told delegates at this year’s Dubai World Insurance Congress (DWIC).

Construction will bounce back - Scor

Hedi Hachicha, Scor’s chief underwriting officer for property and casualty treaty business in the Middle East and Africa (MENA) talks new risks, construction demand, and effective regulation

Signs of life in UAE energy construction market

After three years in relative hibernation, several energy construction projects loom for the UAE

DWIC 2019: Day 1 live and free to read

Click through here to read the first day of GR’s coverage of the Dubai World Insurance Congress 2019

Saudi, UAE health market overcrowded, dropouts expected – Fitch Ratings

Fitch says the compulsory health insurance market is overcrowded and predicts the pressures on profitability will force out weaker players

Health warnings amid profits for UAE insurers

2018 marked a second consecutive year of bumper profits for the UAE’s insurance market, according to an AM Best report

Demand hugely untapped – Willis Re’s Vickers

The insurance sector has a lot to do if it wants to close the protection gap in Middle East markets, according to James Vickers, chairman of Willis Re International

Big challenges face Middle East reinsurance market – Chedid Re

Compulsory lines are the only ones growing in the Middle East, causing commoditisation of products

Aon highlights 8 cyber risk areas

Game-changing business opportunities are created, as well as risks, as companies continue to use technology to speed up information transfer, according to re/insurance broker Aon