Industry Reports 2024

Stronger results at Hannover Re, Munich Re, SCOR, Swiss Re – Moody’s report

Improved underwriting results have driven strong earnings and improved resilience at the four biggest continental European reinsurers, according to rating agency Moody’s.

‘Holiday from history’ is over – Howden geopolitical risk report

A record number of elections in 2024, amid escalating geopolitical risks, underscore the value of political violence and political risk insurance, Howden emphasised.

M&A activity to rise due to “PE dry powder” – BMS report

Strong transaction appetite expected in 2024, according to re/insurance broker BMS, due to private equity capital waiting to deploy.

Fairfax issues further rebuttal to Muddy Waters short seller report

Prem Watsa, chairman and CEO of Fairfax Financial Holdings, has rebutted as “false and misleading” allegations by a short seller about the insurer’s valuation and transaction income.

Fourth Industrial Revolution progress report – Xceedance

The Fourth Industrial Revolution has been advancing more slowly than expected, but generative AI is accelerating change, says Justin Davies, head of region, EMEA, Xceedance.

Misinformation and disinformation threats lead “gloomy” World Economic Forum risk report

The viral spread of fake news and manipulation of the truth online were ranked first, followed by extreme weather events, society’s polarisation, cyber insecurity, and interstate conflict on the roster of short-term risks, according to the WEF’s Global Risk Report 2024.

Industry Reports 2023

AM Best’s ranks top 50 reinsurers: Munich Re, Swiss Re make up a quarter of GPW

Munich Re was ranked top, across non-life and life business, followed by Swiss Re, Hannover Re, Canada Life Re and Berkshire Hathaway.

Disaster financing report shows just 2.7% of $71bn in crisis financing was pre-arranged

Addressing the protection gap, only $1.9bn of $71bn in international crisis financing that was used for pre-arranged finance in 2021, according to a study by the Centre for Disaster Protection.

Q3 surge causes insurtech investment to surpass $1bn – Gallagher Re

Driven by a 25.5% quarter-on-quarter surge in P&C insurtech investment, new funding edged past a billion dollars to $1.1bn during the third quarter of 2023, up 19.8%, according to the latest Global Insurtech Report from Gallagher Re.

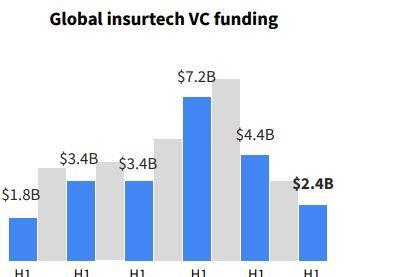

Insurtech VC funding has fallen dramatically this year – report

Insurtech funding falls to 2018 levels, but represents a $7trn market, according to a dealroom.co study backed by insurers Generali and Mapfre.

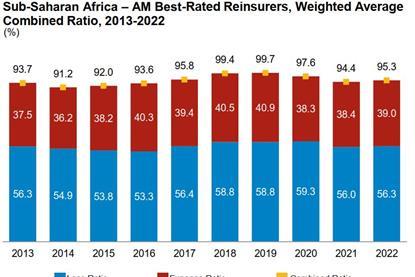

AM Best publishes reports on MENA and Sub-Saharan African reinsurers

The rating agency reports that reinsurers across MENA and Sub-Saharan Africa report topline growth, despite persistent or heightened economic challenges.

Economic and cyber risks lead global D&O priorities – WTW, Clyde & Co

Data losses and ransomware are top legal concerns for company directors, according to WTW and Clyde & Co’s Directors’ and Officers’ Liability Survey Report 2023.

First quarter nat cat economic loss the highest in 12 years – Gallagher Re

Reinsurance broker Gallagher Re said its estimate of $22bn in insured natural catastrophe losses for the quarter showcase “a significant protection gap”.

Political risk is now everyone’s risk – WTW

Nine in ten companies suffered a political risk loss in the past year, according to a WTW report.

Capital market volatility dented reinsurers’ 2022 results – Aon

Aon’s Reinsurance Aggregate finds reinsurers’ net income dipped by more than half last year, producing an average return on equity of 5.2%.

Three factors keeping global non-life reinsurance outlook stable – AM Best

Positive pricing momentum leads the list of reasons why rating agency AM Best has maintained a positive view on the non-life reinsurance sector globally.

Industry Reports Library 2022

Biodiversity risk to become material by 2024

Corporates have just two years to improve due diligence around biodiversity throughout their value chains - report

Global catastrophes cost $343 billion in 2021 - Aon

European floods in July were the costliest disaster on record for the Continent at $46 billion

COCorporates facing ‘resilience fatigue’ - Beazley

Institutional burnout is a particular threat in pandemic-exposed sectors such as health, travel, education and hospitality

ESG is not a fad but an urgent business priority, says IoD

Organisations must identify the risks and opportunities that relate to environmental, social and governance considerations, directors urged

Allianz Risk Barometer 2022: Cyber perils outrank Covid-19 and broken supply chains as top global business risk

The Allianz Risk Barometer is the annual report identifying the top corporate risks for the next 12 months and beyond, based on the insight of more than 2,650 risk management experts from 89 countries and territories.

84% of leaders concerned about world outlook – World Economic Forum

Around 84% of global experts and leaders are worried or concerned about the outlook for the world, according to research by independent international organisation the World Economic Forum (WEF).

Munich Re: Hurricanes, cold waves, tornadoes: Weather disasters in USA dominate natural disaster losses in 2021

Worldwide, natural disasters caused substantially higher losses in 2021 than in the two previous years. Based on provisional data, storms, floods, wildfires and earthquakes destroyed assets worth US$ 280bn.

WEF Report: Climate inaction dominates global concerns

Top risks are climate crisis, growing social divides, heightened cyber risks and an uneven global recovery, as pandemic lingers on

Standard risk management failing to address systemic threats

Joined-up thinking across government and academia is needed to deal with complex environmental risks, finds study

Industry Reports Library 2021

Turbulence after lift-off: global economic and insurance market outlook 2022/23

The world economy is making a strong cyclical recovery from the COVID-19 pandemic, but it is not a smooth one.

Swiss Re: World insurance market set to exceed USD 7 trillion in premiums for the first time

Swiss Re Institute’s latest sigma study forecasts the global insurance industry to reach a new record in global premiums by mid-2022, exceeding USD 7 trillion.

GDP an “unsustainable” measure of growth

Global wealth has grown overall, but at the expense of future sustainability and by exacerbating inequalities, warns World Bank

Q2 2021 U.S. commercial insurance prices continued increasing but at a lower pace

Commercial Lines Insurance Pricing Survey 2021 Q2

Global reinsurance approaching equilibrium: Willis Re 1st View

Reinsurance rate increases continued for most major lines and territories during the 1.6 and 1.7 renewal period; however, in many cases reinsurers had to accept firm order terms below their initial quotes.

Cyber insurance struggling to counter online threat

Cyber insurance has failed to live up to expectations that it may act as a tool for improving organisations’ cyber security practices, finds RUSI

Soaring insurtech investment to impact actuary work and job opportunities – IFoA

The increasing investment in the insurtech sector will have an impact on the type of work actuaries carry out and the job opportunities available, according to the latest report from the Institute and Faculty of Actuaries (IFoA).

Work from home drives greater cyber attack volumes

Close to 80 percent of organisations experienced cyberattacks due to more employees working remotely

Best’s Market Segment Report: Hardening market and regulatory developments in the GCC drive interest in Captive Insurers

A wider gamut of companies is now investigating self-insurance solutions in response to hardening rates in the international commercial insurance and reinsurance markets. Additionally, companies in the region are becoming increasingly sophisticated in their risk management.

IoT data is the risk prevention tool of the future in insurance, highlights new Geneva Association report

The report, authored by Isabelle Flückiger and Matteo Carbone, is based on interviews with over 60 insurers, technology companies, start-ups, global organisations and leading academics across all insurance business lines and geographies.

To protect businesses from pandemic risk, governments need to be ‘insurers of last resort’: new Geneva Association report

Coverage for pandemic business continuity risks with meaningful limits will therefore remain unavailable from the private insurance market due to prohibitively high capital requirements.

WTW - Global InsurTech investment reaches all-time high of US$2.55 billion in Q1 2021

The number of mega-rounds reached eight, more than any other three-month period, according to the new Quarterly InsurTech Briefing from Willis Towers Watson.

WEF: Scenario planning for Industry 4.0

The rapid pace of technological change and pandemic crisis is accelerating trends; making risk forecasting more challenging

Underwriting room could remain Lloyd’s focal point, but its role needs redefining – LIIBA

Lloyd’s of London’s underwriting room could remain a key focal point post pandemic, but its role needs redefining according to the London and International Insurance Brokers Association (LIIBA).

Willis Re: 7% growth in global reinsurance capital, with signs of underlying combined ratio improvement

Total capital dedicated to the global reinsurance industry measured USD 658 billion at year-end 2020 reflecting 7% year-on-year growth. The rise was driven primarily by strong investment market appreciation.

Climate change to transform renewable risk landscape

Renewable Energy Market Review January 2021 - The energy transition: risks and challenges

WEF: No vaccine for climate change

In 2020, the world saw the catastrophic effects of ignoring long-term risks such as pandemics - WEF Global Risks Report 2021

WEF: Why investment in resilience pays off

“It is always cheaper to build a dam than to pay for the flood” - WEF Global Risks 2021

BI and pandemic top Allianz Risk Barometer 2021

Pandemic is a “reminder that risk management and business continuity management need to further evolve”

Reason and logic govern firming reinsurance landscape: Willis Re 1st View Renewals Report

The Willis Re 1st View report is a thrice-yearly publication including specific commentary on key trends throughout the world’s major reinsurance classes and regions

Reports Archive pre-2021

Swiss Re Institute - Power up: insurance-backed investment to fuel sustainable growth in Africa

Insurance will be a key facilitator for investments in renewable energy technologies to meet Africa’s power needs and kick-start growth after this year’s recession.

Special Report: Riding the Cycle

This special report, in partnership with the Dubai International Financial Centre, includes the highlights a roundtable debate hosted virtually by Global Reinsurance in October 2020 and the results of research conducted during September 2020.

Lloyd’s takes action to accelerate transition to sustainable economy

Lloyd’s publishes its first Environmental, Social and Governance Report which details its ambitions to fully integrate sustainability into all of Lloyd’s business activities.

Munich Re’s “Ambition 2025” sets new growth and results targets

With its Group Ambition 2025, Munich Re has specified a series of bold targets for the next five years

Global (re)insurance: capitalisation strong but low interest rates continue to weigh

Willis Re’s Strategic and Financial Analytics teams continue to monitor the financial impact on investment markets and global reinsurer capital positions.

A dangerous new era of civil unrest is dawning in the United States and around the world

As socioeconomic fallout from COVID-19 mounts, we expect the ranks of global protesters to swell over the next two years and unrest to sweep across developed, emerging, and frontier markets alike.

Aon Report highlights a path toward “The New Better” in wake of COVID-19 Pandemic

Aon has published a global report, ”Helping organisations Chart a Course to the New Better,” which presents research, regional findings and trends on how organisations have responded to the novel coronavirus (COVID-19) pandemic to date and are adapting to prepare for other emerging long-tail risks.

Latest report reimagines the London insurance market

The London Market Group (LMG) and Willis Towers Watson today published its latest report reflecting on the lessons learnt from lockdown, what has worked or not and how the market can drive positive change and improve performance in the post pandemic world.

Terrorism: West Africa a new hotspot

Increased instances of human rights violations by security forces pose a major reputational risk for some firms

Lloyd’s report highlights reputation as one of the most valuable intangible assets to global businesses

Lloyd’s, the world’s leading specialist insurance and reinsurance market, today published a new report in collaboration with KPMG, which looks at the role of the global (re)insurance industry in providing risk transfer solutions and adapting to the increasingly complex reputational risk landscape.

After big tests, ILS market shows resilience

Willis Towers Watson: 2020 Global Insurance-Linked Securities Market Survey Report

Insurance losses from U.S. West Coast wildfires to top $8 billion: Aon

Insurance and reinsurance industry losses from wildfires across U.S. states, including California, Oregon and Colorado, were estimated to be more than $8 billion, according to a monthly report on global catastrophes by Aon Plc. Global Catastrophe Recap Report Oct 2020.

AXA records a dynamic rebound of revenues in Q3

”AXA’s strategic choices in recent years, favoring technical risks over financial risks, have positioned the Group well for the future and are confirmed by the Group’s strong performance in the context of Covid-19. The Group recorded a dynamic rebound of revenues in the third quarter, with our preferred segments, P&C ...

Fitch Global Reinsurance Guide 2021

Fitch Ratings has published the 11th edition of its Global Reinsurance Guide. This document provides reinsurance brokers, security committees and reinsurance investors with Fitch’s latest research and views on the global reinsurance sector.

COVID-19 brings intangible assets into full focus - Lloyd’s publishes report today in collaboration with KPMG

Intangible assets are an increasing proportion of companies’ balance sheets, already accounting for as much as 85% of the total business value across industries according to estimates. With the acceleration of digital business models, amplified by COVID-19, this value could now increase much further, becoming a major blind-spot for firms ...

Aon Survey Highlights Steps Companies are Taking to Accelerate Workforce Agility and Resilience

Key findings include HR professionals observing a strong link between diversity and inclusion and developing agile workforces

REPORT: Global guidance on the integration of environmental, social and governance risks into insurance underwriting

After a multi-year global consultation process, leading insurers from around the world and the UN Environment Programme (UNEP) launched last the first global insurance industry guide to tackle a wide range of sustainability risks—from climate change, ecosystem degradation, pollution and animal welfare and testing; to child labour, controversial weapons, and ...